Two groups filed lawsuits Wednesday in King County superior court challenging the legality of Seattle’s just-passed tax on income exceeding $250,000 for individuals and $500,000 for couples.

One of the two group includes a shoe designer, a major Fremont landowner, and a Microsoft executive. The other consists of five Seattle residents and is represented by former state attorney general Rob McKenna and two former state Supreme Court justices.

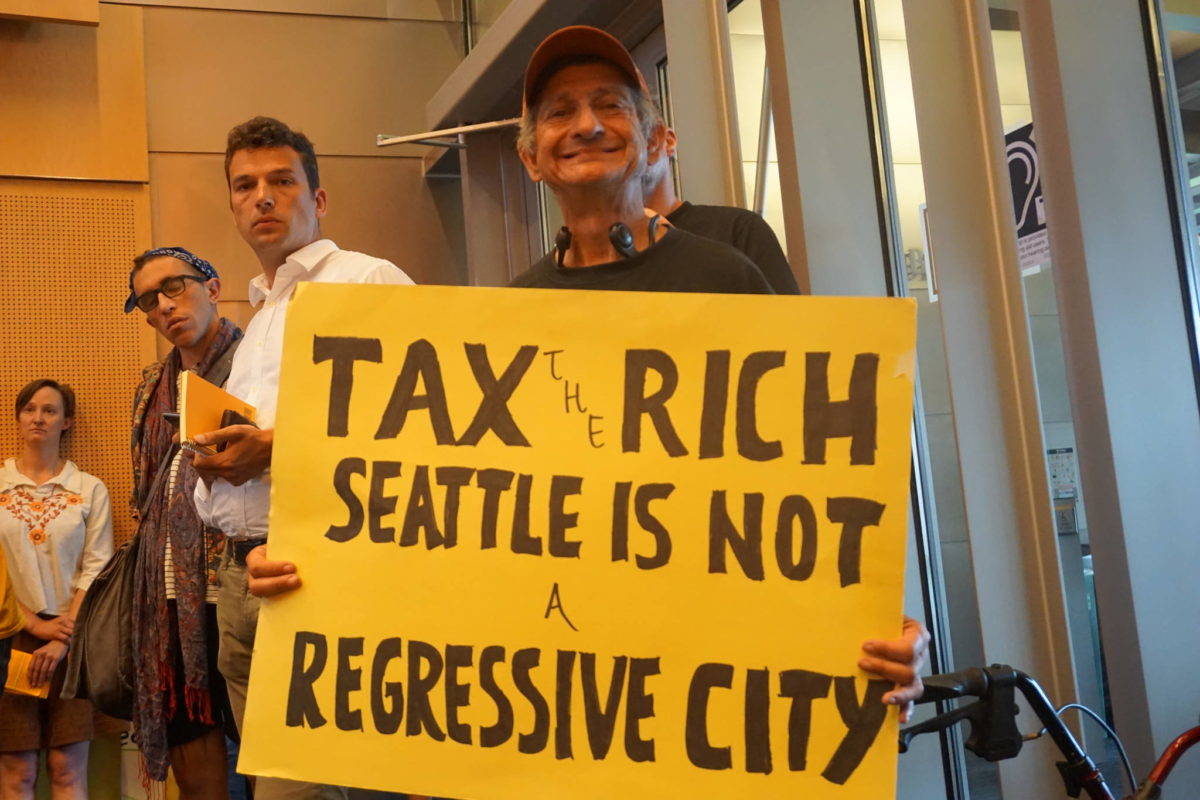

The suits are hardly a surprise, and not the first. One of the purposes of the new law is to test the constitutionality of an income tax on wealthy Washingtonians. The state has one of the most regressive tax structures in the country, a fact largely blamed on a clause in the state constitution that the state’s high court has interpreted to bar progressive taxation on income. Much of the case law on the topic dates back to the 1930s, however, so some legal scholars think there’s a chance that Seattle could get away with the tax.

The tax would raise an estimated $140 million per year. That money is earmarked for cutting other, regressive taxes such as the sales tax and potentially taxes on businesses; backfilling potential federal funding cuts; and financing city projects including housing, education, transit, green job creation, carbon reduction, and administration of the tax.

The income tax passed incredibly fast—it took just a few months between introduction and unanimous approval by the council—with some wealthy tech workers coming forward to ask that they be taxed.

But as the lawsuits show, not all Seattleites are in agreement—and the Freedom Foundation suit has a particularly colorful cast of complainants. That suit raises the obvious constitutional questions about the income tax; argues that cities don’t have the authority to invent new forms of taxation and are expressly barred by state law from taxing net income; says the tax should be subject to a vote of the people; and argues that the plaintiffs’ privacy rights would be violated if they had to submit their income information to the state.

“They want the legal fight straight up, so we’re happy to give it to them,” says David Dewhirst, a lawyer with the conservative Freedom Foundation, which is helping to bring the suit. The Freedom Foundation has teamed up with the law firm Lane Powell in filing the suit.

Plaintiffs in that suit include several prominent members of Seattle’s business community:

Suzie Burke: According to the podcast Rise Seattle, Burke owns “over half of Fremont’s industrial commercial space” and is known as “the land baroness of Fremont.” Her father started a lumber mill along the Fremont Cut in 1939, and she is credited with bringing Google, Brooks, Adobe, and Tableau to the neighborhood.

Gene Burrus: According to a biography on americanbar.org, Gene Burrus is assistant general council in industry at Microsoft, specializing in antitrust. He joined Microsoft in 2002, prior to which he worked for American Airlines in Fort Worth, Texas. He appears on the suit with his wife Leah.

Faye Garneau: Faye! Everyone knows Faye. She is the one who brought us district elections back in 2013; more recently, when developer Martin Selig got cold feet about hosting Donald Trump for fundraiser in Seattle last summer, Faye stepped up.

Nick Lucio: Nick Lucio is listed by Seattle Met as “head designer and co-founder” of the chic shoe company Dolce Vita. According to the website Fashionista, Lucio and co-founder Van Lamprou sold the company to rival shoe company Steve Madden for $60.3 million in cash in 2014. He appears on the suit with his wife Jessica.

Nigel Jones: Nigel Jones is listed as the owner and president of Appian Construction, which provides “quality paving products and installation services,” according to its website. He appears on the suit with his wife Teresa.

Don Root: Bloomberg lists Root as the CEO and chairman of the board at GM Nameplate, which manufacturers graphic overlays. According to a citation that named him a runner-up for Manufacturing Executive of the Year in 2010 in Seattle Business Magazine, GM Nameplate under Root “added plants around the United States and in Singapore and China, and grew to $80 million in revenue.”

Lisa and Brent Sterritt: According to his biography on the website of the Seattle Police Foundation, where he’s a board member, Sterritt is a Marine Corps veteran who is “currently serving in a law enforcement position with the U.S. Government.”

Erika, Ferenc, and Susanna Nagy: Ferenc’s LinkedIn page lists him as a “real estate investor,” and all three are associated with various corporations within the state.

Several other plaintiffs are employees of Lane Powell, the law firm working on the case.

Dewhirst says the plaintiffs consist of people who were gathered by the Freedom Foundation doing “some outreach” and others who volunteered after the law passed.

“A lot of people reached out to us, approached us wanting to help out,” he says.

Dewhirst says they hope to have a court strike down the income tax before it goes into effect, as to save the city money in setting up the expensive taxing scheme.

The suit names as defendants the City of Seattle, the Department of Finance and Administrative Services, and Fred Podesta, the director of FAS. A spokesperson with FAS said it does not comment on pending legislation and referred a reporter to the city attorney’s office.

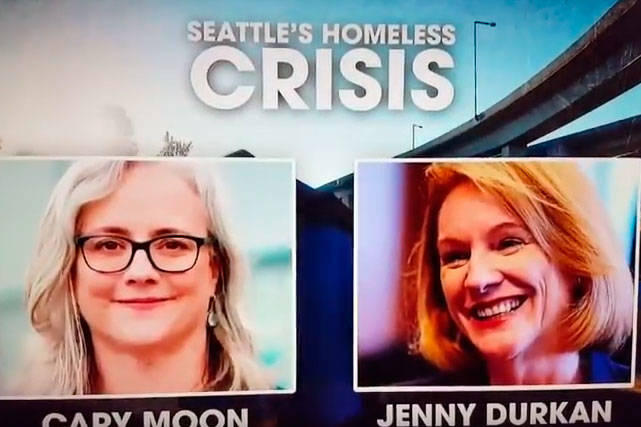

McKenna, who is representing clients in the other suit, told the Seattle Times that the various suits against the income tax will likely be consolidated when they are assigned to a judge in the King County Superior Court.

dperson@seattleweekly.com