The following is a press release from King County:

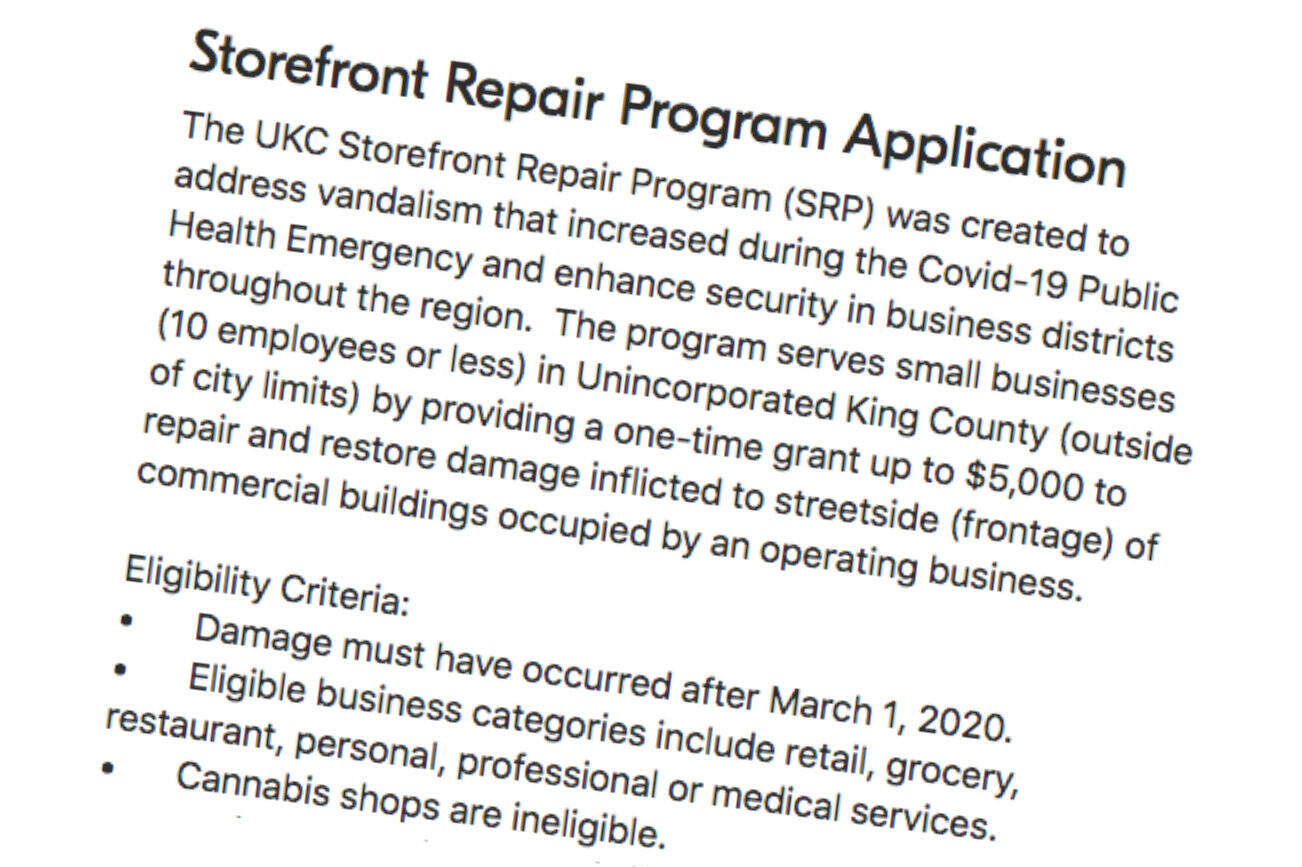

A new grant program is available to small businesses in unincorporated King County that have experienced vandalism or break-ins since the COVID-19 pandemic began in March 2020.

The King County Department of Local Services Storefront Repair Program is intended to address vandalism and enhance security in business districts of the unincorporated areas. The program serves small businesses (10 employees or less) by providing a one-time grant up to $5,000 to repair and damage and restore storefronts of commercial buildings occupied by operating businesses. Retail, grocery, food service, and personal, professional, or medical services are eligible to apply.

Eligible expenses include:

- Repair or replacement of windows, doors, exterior lighting, signs, or awnings

- Replacement of security screens or bars, graffiti removal, security cameras, and insurance claim deductibles

For program guidelines and applications, see the Storefront Repair Grant Program page. For questions or application assistance, email localbusinessgrants@kingcounty.gov

Applications will be accepted Oct. 1, 2023 through Dec. 31, 2023, subject to funding availability.

FAQS

How does the application process work?

The program has a simple online application that you can access HERE. You can input basic business information for eligibility, describe the damage event, and upload photos of damage and corresponding invoices and receipts for repairs. After determining that an application is complete and eligible, Local Services will send you an electronic grant agreement (in DocuSign). Just sign and return the agreement, and your reimbursement will be issued within 30 days.

Will the grants be limited to repairs of storefronts (for example, only to be used for replacing windows and doors)?

Funding can only be used for storefront damage repairs and reimbursement for these repairs. Eligible damages include broken windows or etching on windows, broken doors, broken locks, broken signs, broken fences, and broken gates. However, some security enhancements, like cameras, may be installed in alleys or sides of buildings with grant funds.

Grants are limited to $5,000. Will there be any chance of a grant exceeding that limit in special circumstances (such as excessive damage)?

We recognize that damage will exceed $5,000 for some businesses, but grants will be capped at $5,000 to make sure King County can help as many impacted businesses as possible with limited resources. In cases of substantial damage that required an insurance claim, grant funds may be used to reimburse deductibles paid.

What type of documentation is required for the application?

Applicants must provide before-and-after photos of damage and repair as well as invoices/receipts and proof of payment (copies of check or credit card statement).

What type of businesses qualify for this funding?

For-profit business or nonprofit entities with ground-floor storefronts that serve the public, as well as food trucks, can qualify for Storefront Repair funds. All applicants must have an up-to-date Washington state business license.

How can I get help completing the application?

Local Services staff members are ready to help. Send email to LocalBusinessGrants@kingcounty.gov or call 206-477-3800. Translation and interpretation services are available.

How will grant recipients be selected?

Local Services will accept and process applications on a rolling basis until the available funding is exhausted.

Are police reports required, and how can businesses file a police report?

Police reports are required for graffiti damages but are optional for other damages. Businesses can file a report to the King County Sheriff’s Office at Report to Sheriff – King County, Washington. Storefront Repair Fund applicants can provide their police report incident number during the application process as one of the required documents.

Do awardees need to pay the money back?

No. This is a grant, and businesses are not required to pay the money back. However, grants are taxable, and businesses are responsible for payment of state and federal taxes.

What is the source of funding for the Storefront Repair Fund?

The Storefront Repair Fund is funded by the King County COVID-19 Small Business Assistance Program.

King County encourages everyone to participate in its programs and activities. For additional questions, translation or interpretation, technical assistance, disability accommodations, materials in alternate formats, or accessibility information, please contact the Department of Local Services at 206-477-3800 or LocalBusinessGrants@kingcounty.gov.