Every so often a state will propose legislation that would force Amazon to collect sales taxes on purchases. Amazon typically responds to such propositions with threats to close shipping centers and lay off workers (see: Texas and South Carolina). This usually scares the shit out of legislators who simply cave to the pressure and ax the taxes. But what happens when the sales-tax law is proposed nationwide?Senate Majority Whip Dick Durbin (D-Ill.) says he plans to find out very soon when he introduces the Main Street Fairness Act, which, among other things, would require online retail stores like Amazon to collect sales taxes.It’s not the first time such a bill has been proposed (and rejected) by Congress. But Durbin says he thinks this time will be different.Bloomberg:”This idea is overdue,” [Durbin] says. “Online retail sales are now very fulsome and are growing at the expense of local units of government.” If passed, the taxes are estimated to bring in $11.3 billion in revenue next year.Amazon has long argued that because they don’t have physical store locations, they shouldn’t be forced to collect sales taxes. And in court the company has cited Supreme Court rulings from 1967 and 1992 that say as much.Still, when the sales-tax exemption was carved out for online retailers, it was done to help support what was then a young and relatively small industry. Obviously that’s no longer the case–Amazon has 33,700 employees and cleared 34 billion in revenue last year–so it would seem that the loophole’s days are numbered.So Durbin will introduce his bill and hope that the stars are finally aligned for its passage.How exactly a Republican-controlled House of Representatives votes for a tax hike (on corporations no less!) remains to be seen. Follow The Daily Weekly on Facebook and Twitter.

More Stories From This Author

SBA offering loans for property, business losses from December flooding

Deadlines to apply for personal property loans, which includes damages to personal property and homes, is April 27.

By

Ray Miller-Still • February 27, 2026 11:30 am

Man sentenced for murder behind Muckleshoot Casino

The man received a 20-year sentence.

By

Joshua Solorzano • February 26, 2026 3:25 pm

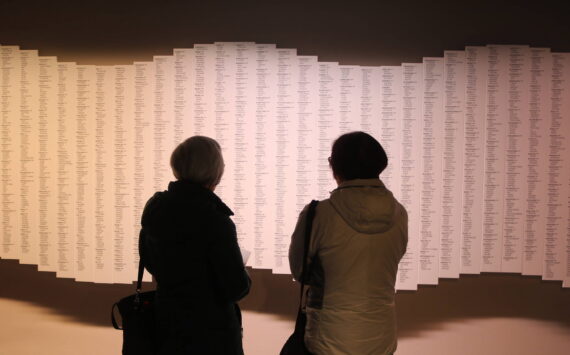

‘Never again is now’: Remembering 125k incarcerated Japanese-Americans

“Never again is now” is the refrain that echoed through the Puyallup Valley Japanese American Citizens League’s 2026 Day of…

By

Keelin Everly-Lang • February 24, 2026 11:24 am