When Precept Brands issued its mission statement back in 2003, the company’s goals seemed modest enough, though difficult to achieve: to produce first-class wine from Washington grapes for prices as low as $5 a bottle. Only a year later, that goal had been achieved and then some. Critics were praising the wines Precept was selling under the Avery Lane label, while its midprice Pavin & Riley merlot and Barrelstone syrah brands (around $12 and $14, respectively) were also moving respectably.

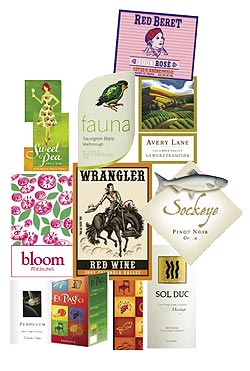

Then all hell broke loose, labelwise. At the moment, I count 22 labels on the Precept Web site—14 wines are made from domestic grapes (all but two are Washington-grown), five are from Down Under, and three are from Europe—and I wouldn’t be surprised to learn that a couple more have been fielded by the time this is published. All those I’ve managed to sample so far have been well-crafted, tasty, and well worth their price, but I couldn’t help wondering about Precept’s marketing plan. Was the idea to put out as many different labels as possible in the shortest possible time, then see which ones caught and which didn’t? A sort of mass-market product testing?

I guess I should have known better. Andrew Browne, whose brainchild Precept is, is no wine-marketing neophyte. Back in 2001, he sold his Washington-based Corus Brands to the Canandaigua wine group for more than $50 million. As random and throw-it-at-the-wall-and-see-if-it-sticks as Precept’s approach has seemed from outside, it makes perfect sense as Browne explains it. Everyone in the wine business fusses about the fact that despite good growth over the last few decades, good wine (as opposed to pop wine and fad wine) remains a niche beverage in North America.

Why? Think about a typical ad for wine. There are well-dressed, sophisticated people on a terrace at sunset, maybe; a romantic atmosphere. The whole mood shrieks “Special Occasion!!!” Even worse is the Mondavi or Gallo approach. Meet the winemaker, who, kind of like God, crafts this exquisitely upscale experience Just for You. Wine advertising, in short, goes for Class, like most liquor ads. Class appeal is fine if you only want to sell to people looking for class in their everyday beverage. And just how many of them are there?

When they craft a brand, Browne and Co. are thinking about the neglected 95 percent of the adult-beverage market. Instead of seeing all customers for wine under $10, say, as a single market, they see a cluster of niche markets. “Even at a particular price point, people have different palates, and the same people are looking for different things at different times,” Browne says. So when a consumer’s looking for something easygoing and agreeable, Precept offers them Avery Lane, with its colorful country byway label art. Pavil & Riley’s label, with its engravinglike illustration of Breugel-esque peasants, looks (and tastes) more assertive and serious. Big Sky’s mountains and moonlight all but says, “Chill, dude.”

Browne freely admits that marketing leads at Precept, but what he told me in 2004 bears repeating. “Good marketing and a good package can make a sale, but if we don’t put quality in the bottle, the customer will never come back,” he says. “We actually try to overdeliver, so they don’t just say, ‘Hey, that’s pretty good wine for the price,’ but, ‘Wow, I can’t believe how good this wine is!'”

With its non-U.S. brands, Precept reverses its field to achieve the same effect with the consumer: “We’re laser-focused with our el Paseo, Red Beret, and Bloom brands to give the consumer a consistent, characteristic experience of Spain’s tempranillo, France’s Cotes du Rhône, and Germany’s Mosel.” And in one case, at least, the approach is paying off nicely. Bloom, with its garish floral label—like a cross between Andy Warhol and a feminine-daintiness product—has sold over 40,000 cases so far.

For a complete overview of the Precept Brands wine portfolio, go to www.preceptbrands.com.