The old robber barons robbed us blind, but at least they were engaged in industries that created jobs: They hired workers to build railroads, steel mills, ships, roads, and mines. Today, while that infrastructure crumbles, a new breed is still robbing us blind but leaving nothing behind. Globalization offers them cover to strip-mine our country of jobs. Buying cheap stuff at Wal-Mart is our reward; working at Wal-Mart our destiny.

It’s gotten so bad that even some of the rich are uneasy.

Billionaire investor George Soros is devoting millions to the cause of defeating George W. Bush in 2004 because of his fear that Dubya’s economic and foreign policies will bring about our ruin.

Warren Buffet, one of our more enlightened barons (he’s in favor of the inheritance tax, for example) worries, too, about the current administration’s economic policies. “If class warfare is being waged in America,” he says, “my class is clearly winning.” He notes that in 1952, one-third of federal taxes came from corporations. Last year, it was just over 7 percent—and business is still demanding, and getting, exemptions, breaks, and subsidies in the name of “competitiveness.”

In exchange, we’re asked to accept a “jobless recovery” and a government deep in debt. What kind of a recovery is it if it is jobless? What kind of recovery is it when all we’ve done is roll back public services? As former Harvard Business School professor Yoshi Tsurumi wrote a couple of weeks ago, America’s gross domestic product (GDP) is growing at 4 percent per year, but “hardworking Americans can’t eat GDP,” no more than French peasants could eat cake. He says income distribution in the U.S—the gap between rich and poor—is starting to make us resemble Argentina or Mexico.

Tsurumi has an interesting perspective. He was one of Dubya’s professors at grad school. Is this the kind of economics Bush learned at Harvard? Tsurumi says Bush came to class with his mind already made up, perhaps by his class. Tsurumi writes: “I still vividly remember him. In my class, he declared that ‘people are poor because they are lazy.’ He was opposed to labor unions, Social Security, environmental protection, Medicare, and public schools.” Well, give him an A for consistency.

One of the most galling aspects of the current situation is that we’re being told it’s good for us. Complainers are “populists” or “protectionists” or enemies of progress. Bush’s advisers tell us we’re mostly mistaken, that the recovery is going full tilt, that manufacturing jobs are just around the corner (at Burger King), and that outsourcing is good for America.

There are cheerleaders on the left, too. No one is more enthusiastic than globalization’s leading apologist, Thomas Friedman, the liberal New York Times columnist and author of the best seller The Lexus and the Olive Tree. He recently returned from Bangalore, India, and filed a series of glowing columns extolling the virtues of the America-funded Indian renaissance. Look at the industrious Indian workers who take our mindless tech jobs—see how happy they are to be employed. They’ll learn our ways and eventually become good customers. And they already speak English!

But the main reason we shouldn’t be afraid of outsourcing, Friedman says, is that Americans will always outsmart the competition. “America is the greatest engine of innovation ever created,” he writes. Indian high-tech firms thrive but are islands of modernity within an old-world culture. In America, high-tech firms thrive because they are part of a culture dedicated to the new. “This is America’s edge,” Friedman says. So don’t worry about outsourcing, because the foreigners can do the scut work—cheap—while we lounge around having big thoughts and maybe conjure up the next bubble.

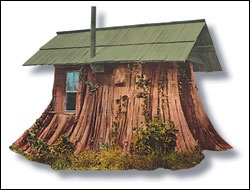

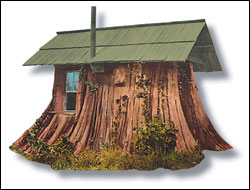

I have to admit, it has appeal. I’d like to have a house full of servants who’ll let me daydream while they do my laundry. But that world is not sustainable, even in the kind of future the globalistas envision, where ideas and dollars—whole economies—are untied to anywhere, above loyalty to anyone. Eventually, reality will catch up with the big-thinkers—perhaps even Thomas Friedman.

Some contend that’s already happening. Richard Florida, the Carnegie-Mellon University professor and author of The Rise of the Creative Class, recently wrote in the Washington Monthly that the U.S. is already seeing its creative edge slip away. America is starting to suffer brain hemorrhage. Our education system is collapsing; the more repressive, conservative post–9/11 political environment is deterring immigration by overseas intellectuals and scientists, the kind of people Florida says helped give us companies like Sun Microsystems, Intel, and Google. In addition, cities that nurture the so-called creative class of innovative entrepreneurs—places like Seattle—are popping up all over the world now and apparently attracting the kinds of people who used to come here, including young, disenchanted, entrepreneurial Americans.

So if the well-paid blue-collar jobs are gone, and the creative class withers or moves offshore, if the middle class is pushed downward and held there by a smaller, richer upper class, what kind of an America are we left with?

One that makes the Gilded Age look like a Golden Age.