The Seattle City Council Monday unanimously approved a 2.25 percent tax on income above $250,000 per year for individuals or above $500,000 per year for couples who file federal taxes together. If the tax withstands inevitable court challenge, it has the potential to revolutionize Washington’s regressive tax system.

The tax will raise an estimated $140 million per year. That money is earmarked for cutting other, regressive taxes such as the sales tax and potentially taxes on businesses; backfilling potential federal funding cuts; and financing city projects including housing, education, transit, green job creation, carbon reduction, and administration of the tax.

The tax does not apply to anyone who earns less than $250,000 per year, and only applies to income above that threshold. For example, a person earning $249,000 per year would pay zero income tax, while a person earning $251,000 per year would pay tax only on their last $1,000.

In Washington, conventional wisdom holds that income taxes are illegal. However, some legal scholars dispute that the state Supreme Court has a clear precedent on this question. Seattle’s income tax is intended in part to test its own legality. A cornerstone of the drafting process for the income tax bill, according to sponsoring Councilmember Lisa Herbold, was writing so as to pass constitutional muster.

City Attorney Pete Holmes was lukewarm about the tax’s legal chances in a press release from City Council. “I recognize there may be challenges, but as your City Attorney I know we have assembled an outstanding legal team to craft the best legislation possible and defend it,” he said.

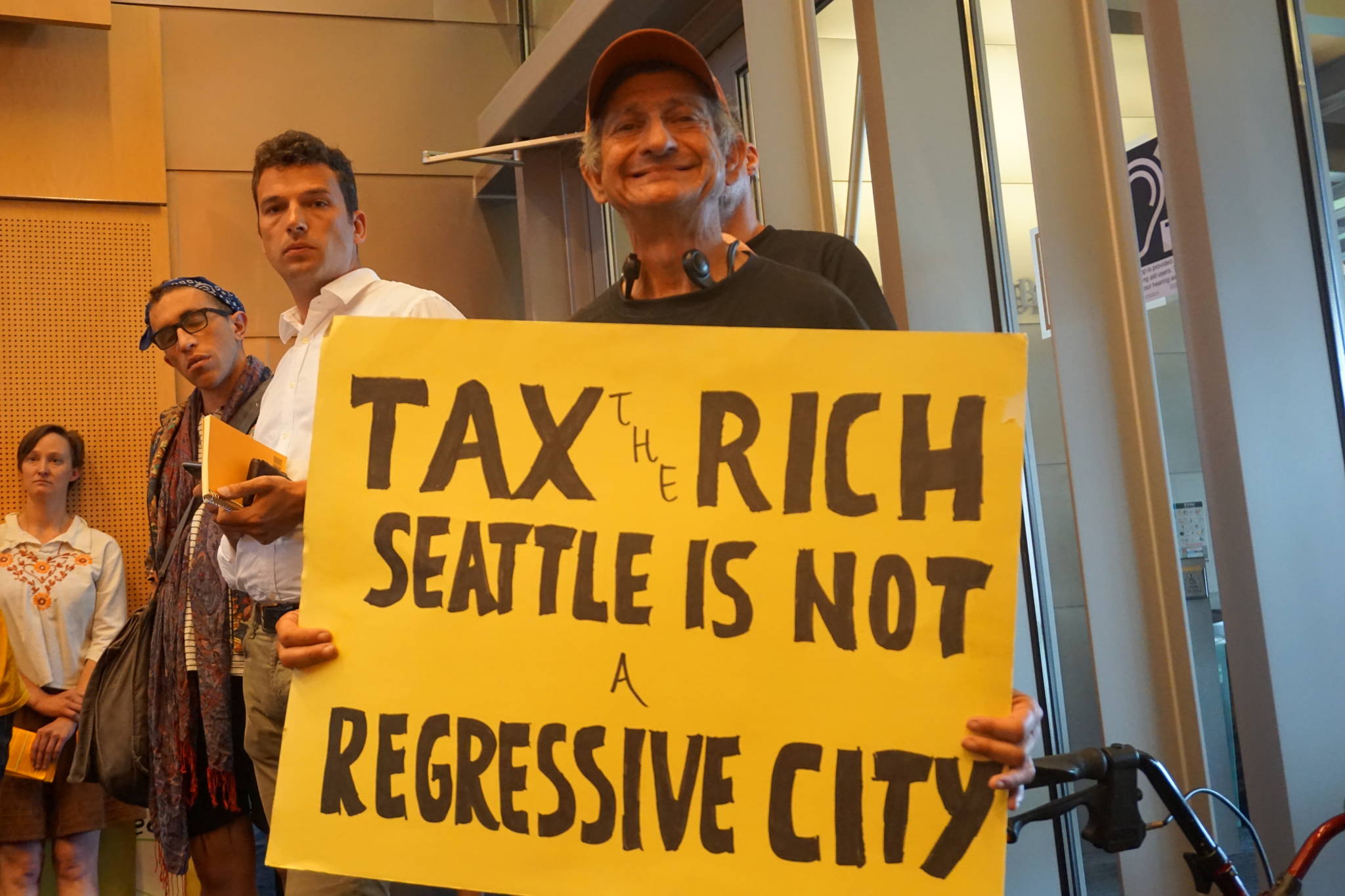

“Seattle is a progressive city, but you wouldn’t know it by looking at our regressive tax structure, and that includes the taxes paid by small businesses,” said Councilmember Lisa Herbold, who co-sponsored the legislation with Kshama Sawant, according to the release. “When our poorest households are paying 16% of their income in state and local taxes while our highest earners are paying only 2.4%, we have a very clear problem. Today we are taking a step in the right direction, toward tax fairness.”

“We live in a deeply unequal society,” said Sawant in the release. “Throughout history, it has been mass movements of ordinary workers and young people, not the political representatives of big business, that have won change. Since I first ran for office, Socialist Alternative and I have organized for a $15 minimum wage, taxing the rich, and rent control. Our growing movement has now won $15 and taxing the rich. We can continue organizing to win not only rent control, but a world free of exploitation and oppression.”

The income tax is scheduled to take effect the first day of 2018, with collection beginning in 2019 during federal tax filing season in April. According to the release, the Department of Finance and Administrative Services will go though a rulemaking process for how to administer and implement the tax, due to be finalized by November 15, 2018.

cjaywork@seattleweekly.com