Tim Blixseth’s six-bedroom, five-bathroom estate was sold a few months ago for the price of a very nice Winnebago. The two-level home with a finished basement sits on 110 feet of Lake Washington waterfront in Medina and has stunning views of the water and nearby mansions. Blixseth, a slightly balding and compact 64-year-old real-estate developer, didn’t particularly want to sell the home where he lived with his third wife. He even fought it in court, claiming a Chinese consortium offered him $10 million for the place, but lost. In the end, only one purchaser showed up for the June sale, and got quite the deal: $250,000 for a 6,800-square-foot home with a covered dock.

Well, what the hell, Blixseth might tell you: The dock was too small to tie up his yacht anyway. He didn’t want to part with that either, the last of three yachts he’d owned in the past two decades, worth a total of $25 million. But he apparently did; though, like the house sale, mystery surrounds the deal. He says he had a $2 million offer for the 157-foot Piano Bar, as it was named, and the gleaming white luxury yacht is seemingly no longer in his possession. Yet creditors are searching for it, and one is even offering a bounty to anyone who can show Blixseth’s still the captain.

If you’re sensing that Tim Blixseth is in some kind of financial downspin, you’re right. He tries to be upbeat about his setbacks, but they’re piling up, and creditors and courts have accused him of deceiving them with his legal gamesmanship. Dramatic court moves are not untypical of him, but in the past, it was always Blixseth who came out on top. He wheeled and dealed to buy timberlands and develop resorts on his way to becoming a billionaire. He lived the good life among other billionaires and mere multimillionaires in the neighboring upscale enclaves of Medina, Hunts Point, and Yarrow Point, where police are sometimes summoned to chase ducks from rich folks’ swimming pools. The cops also keep automatic weapons around should they be needed to safeguard presidential fundraising visits, such as Barack Obama’s $25,000-a-plate dinner in July at a former Costco CEO’s Hunts Point mansion.

Blixseth might still be a landowner on 73rd Avenue Northeast if only he wasn’t as good at losing money as he has been at making it.

That dwelling is just up the road from Blixseth’s nearly half-acre ex-paradise, on a street that dead-ends at the lake. It’s two blocks south of Bill Gates’s spread, a verdant solitude of waterfront abodes with sloping gardens and matching L-shaped docks. Thing is, Blixseth might still be a landowner on 73rd Avenue Northeast if only he wasn’t as good at losing money as he has been at making it.

The Oregon native has been camped out in attorneys’ offices and courtrooms for a good part of the past eight years—federal court dockets alone list his name on 159 cases involving bankruptcy, civil actions, and appeals, many of them filed by Blixseth himself. He is being hounded by creditors and, because of his aggressive legal moves, assailed by the courts. In varied rulings, judges have concluded that Blixseth and his business entities used “scorched-earth [and] unprofessional litigation tactics,” demonstrated a “pattern of sanctionable behavior,” and “elected to use every procedural mechanism of our legal system to evade . . . contractual obligations, obfuscate, manufacture disputes, and leverage its business position in a duplicitous manner.”

The battle over his Medina house is a microcosm of this legal warfare. Back in May, when he went to court here to save the home, he confidently announced the litigation “will be settled in the near future.” But, even though the home has been sold, the house battle is alive and well and scheduled for another court hearing this week.

Blixseth presents a blurry portrait to the world—he refers to himself as a developer, record producer, songwriter, and timberman who tries to do the right thing. “I’m as imperfect as the next guy,” he writes of himself on his web page, “but I’ve tried my best to live by certain core values my whole life,” including working hard, seeking justice for all, and not letting your possessions define you. But possessions—from huge commercial projects and luxury homes to private jets and business-partner wives—have defined him nonetheless through his legal battles to keep or discard them. He’s also been on a financial roller-coaster ride, from rags-to-riches-to-rags-to-riches again, leaving creditors dizzy attempting to determine what he’s got left in the bank or offshore. One thing is clear, however: No one calls him a billionaire anymore.

By the time Tim Blixseth married his second wife, Edra Crocker, in 1983, the man who’d grown up poor eating Spam five times a week had evolved into a multimillionaire Northwest timber baron, buying and logging vast swaths of forest. Three years later, with $15 million in debts and about $4,000 in assets, he and Edra declared bankruptcy. Three years and more timber deals later, Blixseth was back, more experienced and moving more cautiously as he turned into a multimillionaire again, then expanded into real-estate development.

By 2006, Blixseth had made the Forbes 400 list of richest Americans. He traveled the world looking for investments and hung out with the rich and famous. He also leveraged his connections and extracurricular talents to help people. He had a lifelong love for music, having bought a piano and guitar as a youth and taught himself to play and write songs (he has 10 songs registered with Broadcast Music Inc.). He ran his own record company in the 1990s, and was nominated for a Grammy in 2008 as executive producer of Eric Benet’s R&B album, Love & Life. In 2005, after Hurricane Katrina slammed New Orleans, Blixseth donated $2 million to the recovery effort and wrote a song—it came to him in a dream one night—called “The Heart of America.” It was performed by Benet, Michael McDonald, and Wynonna Judd and helped raise $127 million for storm victims.

By then, Blixseth had homes in Medina and California and a fortune estimated at $1.3 billion. He seemed to have the ability to fall backwards into money—in one case cited in court records, he issued a $5 million promissory note for an interest in a condo development, and in less than a year flipped it for $60 million. But he had also begun to sow the seeds of his demise, staking his future on building a posh resort in Montana, dubbed the Yellowstone Club, with multimillion-dollar chalets set around a $100 million lodge. The ski and golf resort, with a caviar bar, opened around 2005.

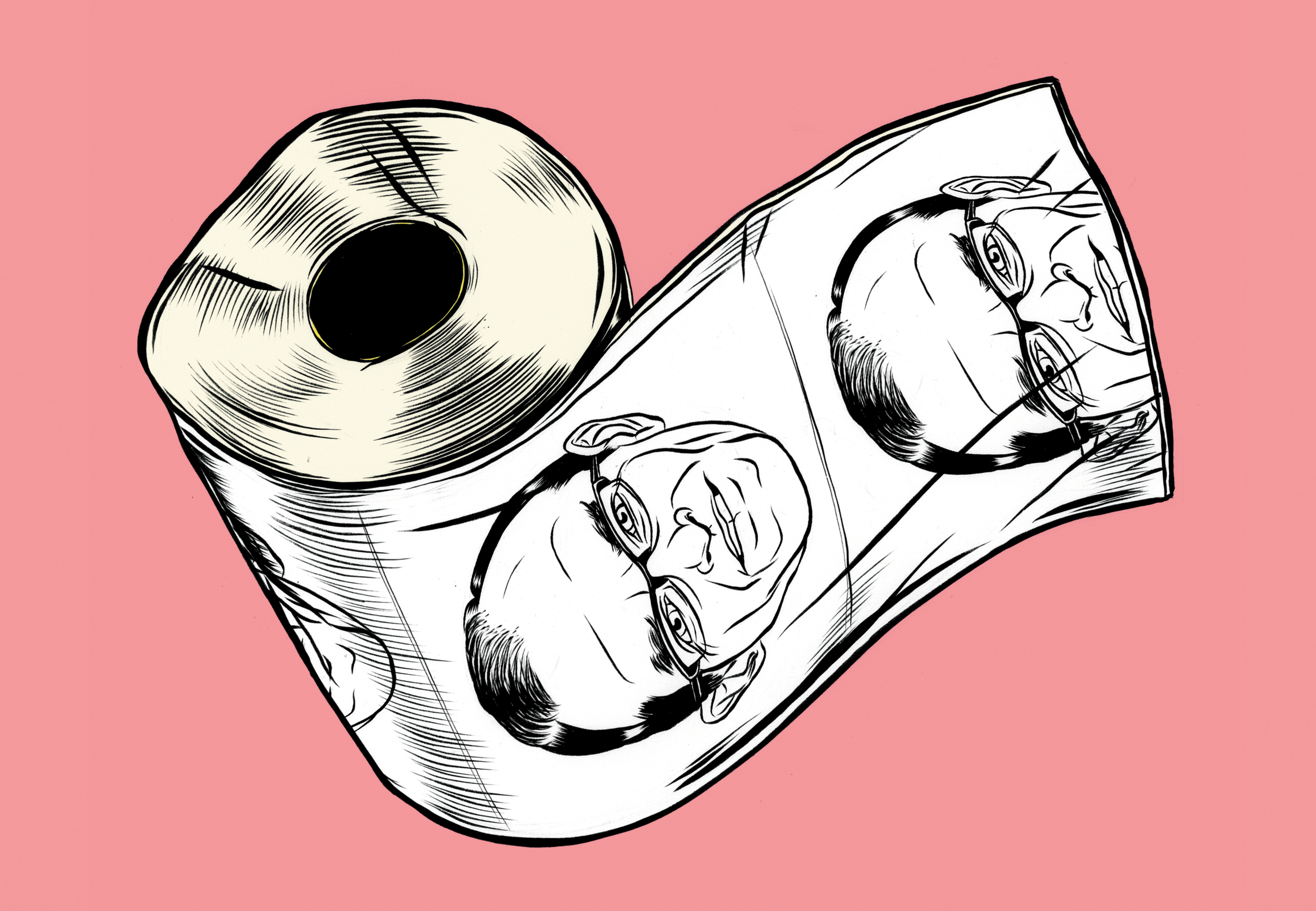

To celebrate their breakup, his ex threw a $90,000 party at which she handed out toilet paper with his face printed on it.

Blixseth hired ex-Secret Service agents to watch over his deep-pocket investors and members, such as Dan Quayle, Bill Gates, and a shipload of captains of industry and sports figures such as Tour de France winner Greg LeMond (who would later sue Blixseth, claiming he’d been cheated). Many of the eventual 300 club members—you had to be invited to join—built resort homes ranging from $5 million to $25 million.

Yet just three years later, in 2008, the resort would be headed for bankruptcy and Blixseth mired in a nasty divorce. To celebrate their breakup, his ex threw a $90,000 party at which she handed out toilet paper with his face printed on it. (Blixseth, in a weak return volley, referred to her as “the center of evil.”)

At that point, Blixseth’s personal worth had gone off a cliff. Edra would end up with a chunk of it—including a Gulfstream II, a BMW, and a 2004 Rolls-Royce Phantom, along with a mansion in Palm Springs, a chateau in France, and control of the Yellowstone Club. The Great American Mortgage Meltdown eroded a lot of what was left.

T he resort was his chief folly, but Tim Blixseth racked up other memorable adventures in investing that came to haunt him. He bought, for example, a Mexican resort for $40 million and ended up selling it for $13.8 million (and this year was fined that amount by a federal judge because he pocketed the money at the same time he was declaring bankruptcy). Then there was a business venture with a man who is now one of his Yarrow Point neighbors, Dennis Montgomery.

Montgomery was the proprietor of a Nevada computer-software company called BLXware. Within the past decade, Edra, Tim, and one of their investors, former presidential candidate Jack Kemp, went in on the company, funded in part by money the Blixseths had borrowed from the Yellowstone Club’s bank accounts. Montgomery, who drove a $70,000 Porsche Cayenne GTS and who once lost more than $400,000 in one day at a California casino, would become known as “The Man Who Conned the Pentagon.” At least that was the headline of a 2010 Playboy article about Montgomery, who had claimed he’d created software that could decode secret messages embedded in Al Jazeera Media Network broadcasts and intended for would-be terrorists.

After Edra and Tim had made their investment, Kemp used his connections with Vice President Dick Cheney to gain an audience with the Pentagon. The military ended up paying millions for the software—which didn’t perform as promised. The Playboy story contended that the demonstration results that preceded the sale were in fact faked.

Montgomery fell on hard times—he was arrested for allegedly passing $1 million in bad checks on the Las Vegas strip and later filed for bankruptcy, listing debts of $12 million. Today he is reportedly working with infamous Arizona sheriff Joe Arpaio, developing a computer-assisted program that could help the paranoid lawman identify anyone who conspires against him. I talked to Montgomery outside his impressive $2 million Yarrow Point home—which his attorney, who has also been Blixseth’s attorney, was able to buy for $20,000 through bankruptcy proceedings. Montgomery repeatedly said he had no comment about anything I would ask him. (See “Sheriff Joe’s Seattle Connection,” June 11, 2014.)

It was a wild ride on the Blixseth money train—until it began to lose steam, that is. Besides divorcing Edra (and in the process duping her into taking over the debt-ridden Yellowstone development, she says), Blixseth also later sued his ex-wife and others, including the bank Credit Suisse, from which he’d gotten a $325 million Yellowstone loan. The suit was a dramatic attempt to recover all his losses and then some: He sought $6 billion in damages, contending the ex and others had participated in a racketeering conspiracy against him. Edra would later claim it had been Tim who had “looted the companies and taken the cash.” In 2011, Tim also sued one of his attorneys who he claimed conspired against him, and filed a $9 billion suit against a bankruptcy trustee. None of the suits have succeeded.

As the real-estate meltdown loomed, Blixseth had seemed unafraid of market changes, announcing plans to build a $155 million home for himself at Yellowstone—it would have been the world’s most expensive home, he claimed. That eventually fizzled out, like his Yellowstone dream. In 2009, after Edra had taken over the resort and declared bankruptcy in hopes of reorganizing, it was sold for $115 million to a Boston company. The elaborate Palm Springs home she won in the divorce, with 16 bedrooms and 269 acres of land, was put on the market for $75 million, but was sold to software billionaire Larry Ellison for $43 million.

Today, with much of the legal dust settling and court decisions lining up against him, Blixseth is reportedly down to his last $200 million. But records show he owes far more than that in unpaid taxes, penalties, and court judgments, most of which he is fighting or appealing.

In June, a federal judge in California issued a $200 million judgment against Blixseth for fraudulently transferring money from the Yellowstone Club. The resort’s lawyers have since sought Blixseth’s arrest for contempt for selling and not turning over the funds from the Mexican resort sale, a charge he continues to fight. Earlier this year a Montana bankruptcy judge ruled that “Blixseth’s fraudulent intent could not be more clear,” and ordered him to pay $41 million to creditors.

Tim Blixseth in front of the 120,000-square-foot Warren Miller Lodge at Yellowstone Club. Courtesy Bozeman Daily Chronicle

Other creditors claim he owes as much as $45 million in defaulted loans and penalties, and Blixseth also owes millions in unpaid income tax, according to court records. This year, he filed twice for bankruptcy—in part as an effort to save his home. But, effectively, the billionaire is busted.

“Mr. Blixseth is broke,” one of his attorneys, Michael Flynn, emphasized to a federal judge earlier this year. “As far as I know, his fight for justice has exhausted all of his resources.” Flynn said Blixseth owed him money as well.

West Virginia attorney Brian Glasser doesn’t buy it. According to Glasser—who is trying to collect on the Yellowstone debts—and court records, Blixseth transferred $209 million of the borrowed Credit Suisse funds into his personal holding company, spending $100 million of it on foreign investments—buying, among other things, the Mexico resort and the French chateau. “Blixseth attempted to insulate himself from the original debt by assigning all liability to his wife in exchange for her taking the Yellowstone Club property as part of their divorce settlement,” Glasser says.

Frustrated, Glasser is now offering a public bounty of 10 percent to anyone who exposes any assets Blixseth might have hidden. “There could be land holdings abroad, land holdings in other people’s names. That’s why we’re appealing to the public,” Glasser said. He contends that Blixseth still owns the 157-foot Piano Bar, which the once-billionaire had indicated in U.S. court records was being sold for $2 million. Blixseth said he was “working on getting the cash back in the U.S.” from the buyer’s offshore account to settle the yacht sale, and in May claimed $50,000 had been wired to him as earnest money for the sale. But in a July filing in King County Superior Court, he indicated the deal had fallen through. Blixseth revealed that he had registered the yacht under one of his companies, Western Air & Water, and was selling it to a company called Eastern Air & Water. He insisted Eastern was “unaffiliated” with Western. Attorney Glasser also suspects Blixseth is flying around in a Citation jet that could be registered to a family member.

Blixseth’s chest-thumping response to Glasser’s bounty was to make a counter-bounty offer. In an e-mail to the Associated Press, he claimed he “will better their ‘bounty offer.’ I will offer [a] 50 percent reward to anyone who can find any hidden assets of mine.” The trust fund that Glasser represents in the action, Blixseth said, aims to “ransack me and my financial ability so badly [that] I would give up and be bludgeoned into ineffectiveness in my pursuit of justice.”

That’s the kind of one-upmanship strategy Blixseth seems to love, court files indicate, helping him stay a step ahead of bill collectors.

I asked Blixseth a few weeks ago if he was broke, and if he was hiding any assets as some of his creditors claim. He said he was in a meeting and would get back to me later that afternoon. He didn’t. He later e-mailed to say, “When I didn’t hear a response from you, I assumed you didn’t get e-mail or [it was] hung up in spam.” He didn’t respond at all to follow-up messages.

It was 2007 when Tim Blixseth bought the grand house on Northeast 73rd Street that would eventually sell for $250,000. He purchased it through a new company he had formed, Kawish LLC, paying $7.9 million. When the good times faded, Blixseth found himself juggling investments, falling behind in tax payments, then stalked by Yellowstone creditors. As myriad debt cases progressed through the federal courts and millions in judgments began piling up, creditors came for Blixseth’s house, which had been put up as collateral for some of the loans.

Tim and Edra had already gone through their bitter divorce, and Tim was living in the Medina home with new, younger wife Jessica Ferguson Kircher, then 39, whose family was also involved in the Montana resort business. They were wed in 2010. In a legal move, he put her on the Kawish incorporation papers as an official of the company. In an apparent attempt to protect his assets, he later drew up an agreement whereby the company would lease the home to Jessica, with $55,000 rent payable by her every six months.

Jessica and Tim Blixseth. Photo by Red Fish Blue Fish Photography

A pair of Nevada-based trusts, known in court as the Prim Trusts or the Prim Entities, hoped to collect on defaulted Yellowstone-related loans to Blixseth. Filings indicate Blixseth owes the trusts about $10 million, although the lenders are seeking as much as $45 million with damages and interest. To collect some of that debt, they filed for foreclosure on the Medina home in 2012. Blixseth fought the action but lost, then declared Chapter 11 voluntary bankruptcy to stave off a pending sale.

At a U.S. court hearing earlier this year, Seattle bankruptcy judge Marc Barreca said Blixseth’s bankruptcy had not been filed in good faith. “The facts, instead,” he said from the bench that day in an oral ruling, “indicate that the bankruptcy case was filed as a litigation tactic to hinder and delay the Prim Entities’ efforts to foreclose upon the debtor’s primary asset, a multimillion-dollar home on Lake Washington, for the benefit of the debtor’s ultimate owner, Timothy Blixseth or Mr. and Mrs. Blixseth.”

Barreca noted that Blixseth had never bothered to file a bankruptcy reorganization plan and failed to comply with bankruptcy reporting requirements. “Notably,” the judge added, “despite having abundant notice and having been identified by the debtor as a witness, Mr. Blixseth failed to appear and testify at [his bankruptcy] hearing on February 14, 2014.”

Blixseth’s home was once again scheduled for foreclosure. But on May 8, an hour before the sale was to be held, he again filed for Chapter 11 protection. He also claimed to have a purchaser for his property who could help pay his trust debt. Paul Brain, Blixseth’s attorney, identified the buyer as Jia Lin Niu, who heads a Chinese real-estate investment syndicate and lives in Bellevue. One of her entities, according to county records, has bought $39 million worth of property in King County over the past two years.

The consortium is one of many wealthy Chinese entities scouring the Eastside for luxury home investments. According to the National Associate of Realtors, wealthy Chinese make up the largest group of foreign buyers in the United States, spending $22 billion in a recent 12-month period. Agents estimate that 40 percent of $1-million-plus Eastside home buyers are Chinese. They find Medina alluring as the nest of such billionaires as Jeff Bezos and Gates. “The first question you often hear from Chinese clients is ‘Where does Bill Gates live?’ ” Moya Skillman, a Windermere Real Estate broker, recently told The New York Times. Next to Tim Blixseth would be a fitting answer.

“Money and objects are wonderful, but we only rent them while we’re here on Earth. As we say in real estate, they don’t convey.”

Attorney Brain submitted a court document that said Jia Lin Niu was willing to pay $10 million for the Blixseth home, which would fund a bankruptcy reorganization allowing Blixseth to parcel out repayments on a scheduled basis and help pay off the debt.

But trust attorneys were suspicious. They noted that after the first bankruptcy was dismissed, Blixseth transferred Kawish ownership to wife Jessica, who was acting as both landlord and tenant, and who then waived her own rental payments (which the trusts were also hoping to seize).

Also, Kawish was once again seeking to reorganize, despite still having no equity in the home, no other assets, and now no income, trust attorneys complained. “All facts and circumstances surrounding this dispute,” said the trust in a filing, “point to the same conclusion: that Kawish has again filed a Chapter 11 bankruptcy petition in a bad faith effort to frustrate the Prim Entities’ efforts to collect the debts owed them and to allow Blixseth and his wife to continue living in the Medina mansion free of charge.”

Blixseth’s second bankruptcy failed like the first, and the $10 million sale was not permitted. On June 13 the foreclosure sale went ahead, with Prim Trust as the only bidder, paying a quarter million for the property. The trust is now listed on county records as the official owner of the home, which the county has appraised at $4.5 million.

But Tim Blixseth is not through. In July he filed a complaint in King County Superior Court seeking damages and attempting to take back his home. He contends the trust should have acted on his offers to sell the home for $10 million and the yacht for $2 million, allowing him to reorganize and avoid foreclosure. The money would have been available within two weeks of the foreclosure sale, he claimed.

Blixseth had been hoping for an outcome somewhat like that of one of his neighbor’s homes after they declared bankruptcy. Elderly developer Mike Mastro and wife Linda Mastro—now on the run from federal authorities and living on U.S. Social Security in France—declared in 2010 what was thought to be the largest bankruptcy in state history: about a third of a billion dollars. After the duo absconded, they were allowed by a French court to avoid extradition to the U.S. because of their ailing health (they could still be arrested for fraud and money laundering should they cross the French border). A trustee was able to recover only one cent on the dollar for Mastro creditors. But their Medina mansion—just up Evergreen Point Road from Blixseth and bought for $15 million in 2006—sold for a reasonable $9.1 million in 2011, helping cover some of their debts. (See “How to Go Bankrupt, the Millionaire’s Way!”, Aug. 14, 2013.)

Compared to that, the quarter-million-dollar sale of his home was a “grossly inadequate” outcome, Blixseth said: “The conduct of [the trust] chilled bidding at the foreclosure sale as evidenced by the fact that no third party bidders attended the sale.” He is now seeking to set aside the transaction or, if that doesn’t happen, to be awarded damages of $10 million. The trust is moving to dismiss the case, and a hearing is set for this week.

In my inquiries to Blixseth, I asked him for any comments he’d like to make about this and other cases, to which he didn’t respond. But here’s what he says about his assets on his website, listed under a section called “Values” and apparently posted in 2012:

“I’ve certainly enjoyed my fair share of possessions, but I’ve never let them define who I am. A television interviewer once asked me if he could call me ‘rich’ in his program. I told him, ‘No, you can call me Tim.’ Money and objects are wonderful, but we only rent them while we’re here on Earth. As we say in real estate, they don’t convey. Let your character define you, not your things. If you’re defined by your possessions, you are undefined. Today, I have a wonderful family. And I have found the love of my life, my wife Jessica. In that sense, yes, I guess I couldn’t be richer.”

randerson@seattleweekly.com

Rick Anderson writes about sex, crime, money, and politics, which tend to be the same thing. His latest book is Floating Feet: Irregular Dispatches From the Emerald City.