It’s probably safe to say that Dorothy Strand Gorman doesn’t normally call attention to the rundown aspects of her house, situated in a tony part of Belle-vue called Somerset. But when she got a notice from the King County Assessor’s office valuing her home at $588,000–a figure that will determine her property taxes for the coming year, and one that represents a $70,000 increase over last year’s assessment–Gorman, a property appraiser by profession, turned a practiced eye on her own house.

For a petition appealing the assessment to the King County Board of Appeals and Equalization, Gorman filled out a formal appraisal report listing 10 issues of “functional obsolescence”—and included photos. There, in Gorman’s file, are “sagging refaced cabinets,” “rotting” bricks, “end of life fences” with crooked planks, a “broken drawer,” “damaged kitchen Formica,” and more. Plus, as she notes on a form submitted with her petition, her house lacks the million-dollar views of her neighbors, is located on an arterial with speed bumps, and falls outside the enrollment boundary for sought-after Somerset Elementary School. She suggests a value of $563,000, which, going by this year’s Bellevue tax rate, would save her about $560. (Tax rates change every year and vary by area.)

Dave Goff, manager of the county appeals board, says it’s “most unusual” to see appraisal reports filled out by property owners themselves. “It kind of takes away from the independence,” he muses. (Gorman declined to comment publicly on her case in advance of her hearing.) But with or without formal reports, it’s not at all unusual for property owners to hang their dirty linen—or bad paint jobs—in public when their taxes are on the line.

As the real-estate downturn fuels an economic meltdown, Goff’s office has received more than 4,000 appeals so far. He expects about 8,000 before the year is done—more than twice last year’s figure. And it often pays to appeal: Last year, almost half of homeowners who did so had their assessments revised downward.

This year, taxpayers feel particularly aggrieved. “The most common comment we get is ‘How can assessments be increasing when values in the market are declining?'” Goff says.

In fact, the spike this year—approximately10 percent above last year’s total assessed value onresidential properties throughout the county, according to Assessor Scott Noble—reflects the real-estate boom of years past. The Assessor’s office determines property values based on a three-year average. Thus this year’s assessments incorporate values for 2005, 2006, and 2007—before thereal-estate downturn began in earnest.Even so,assessmentsare still falling slightly below current market values,claimsNoble, who says his office took a look at 2008 sales after people started complaining. But he concedes “it’s tough for someone who reads the paper”—bearingheadlines about falling property values—”and gets a notice in the mail that shows a 10 percent increase.”

Hit with an assessment of $1.2 million on his five-bedroom, three-and-a-half-bathroom Bellevue house, D. Gao cites in his petition the “useless land” on a “big slope” that serves as his backyard. He estimates his house is worth $1.1 million. With a similar-sized house and a three-car garage, Andrey and Popova Bondarenko claim that their quarter-acre lot “is the smallest” in their neighborhood of West Summit, Bellevue. Their property was valued at $1.15 million, and they’d like to knock $50,000 off that. Meanwhile, Enumclaw resident Linda Reynolds recently argued that a seven-acre wooded tract of land she owns, valued at $208,000, is “very uneven and hilly.” A creek running through a ravine would further limit building on the site, she wrote, before ultimately estimating the value of her home at $160,000. The board ended up settling on $190,000.

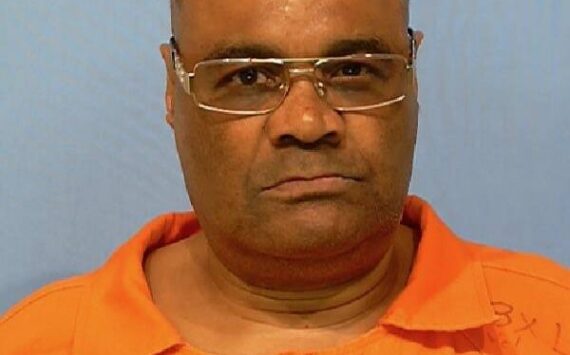

In a hearing last week before two of the seven members of the appeals board, Isham Huizar didn’t openly criticize his Crown Hill two-bedroom, valued at $417,000. But when a representative from the Assessor’s office, Scott Kendall, justified that value by showing a picture of the house next door, which sold in December for $517,000, Huizar protested that his home didn’t compare.

“This neighbor redid everything,” says Huizar, a medical researcher at the University of Washington. “He put in new trees, a new garden, a new irrigation system for the front yard. He redid the floors and refinished all his living space in the basement.”

The board will rule on Huizar’s appeal in about a month.

The more negatives a homeowner can cite, the better, according to Harley Hoppe, a former King County Assessor who now runs a Mercer Island business called Harley H. Hoppe & Associates, which helps property owners appeal their assessments. Hoppe says that when he meets with clients, one of the first things he asks them is whether they have any problems, like steep slopes, a bad roof, or a wetland, that limit development. But, he cautions, “You can’t just come in and say ‘I have a wetland.’ You’re going to need a statement from a wetland expert.”

Likewise, Barbara Alsheikh, supervisor of King County’s Property Tax Advisor Office, an entity independent of the Assessor that helps taxpayers with their appeals, suggests that people take pictures of their kitchens and bathrooms, which she says can come in handy in a situation in which “you have Formica and everyone else in the neighborhood who’s selling their home has ceramic tile or Corian.”

Alsheikh adds that some people talk trash about their homes only when it’s useful. “You’d be amazed at how many people appeal while simultaneously listing their house on the MLS [Multiple Listing Service] for much more” money than they claim it is worth for tax purposes. She remembers the owner of a Kirkland mansion, who a few years back unsuccessfully appealed an assessment of $2.7 million while putting the property on the market for $3.2 million. Beware, though: An appraiser from the Assessor’s office might just stop by the house for sale and pick up a flyer advertising “all the wonderful things” about the home, she says.

One appeals petition on a Queen Anne townhouse includes a listing for the property from when it was on the market earlier this year. The listing documents that the home was priced at $449,000, way below the Assessor’s value of $567,000. And, according to Mark Potvin, a real-estate agent and developer who built the house last year, it never sold.

Still, the listing’s marketing hype stands in sharp contrast to the language in the appeal. “Exceptional quality!” reads the listing. “This urban Queen Anne home features finishes usually found in homes twice the price.” Among the selling points: “high ceilings, fantastic kitchen with custom hardwood cabinets, honed limestone counters” and “custom tile.” But Potvin makes a different point about the house on his appeals petition: Unlike the adjacent townhouse he built, which sold for $515,000, this one “does not have the Puget Sound views.”

By phone, Potvin says he doesn’t feel odd about the discrepancy between the two descriptions, since both are accurate. The townhouses he built are “beautiful units,” he says, but one has a “panoramic view” of the water, while the one whose assessment he’s appealing merely looks out on an apartment building.

It’s just that at tax time, you’re more likely to hear what’s wrong with a house than what’s right.