On Monday, Mayor Ed Murray and City Councilmembers Kshama Sawant and Lisa Herbold finally unveiled their first draft of a bill that would create a city income tax. If it passes and survives an inevitable court challenge, the tax has the potential to replace regressive taxes all across the state. Council will hold a public hearing on the proposed tax Wednesday, June 14 at 5 p.m. in City Hall.

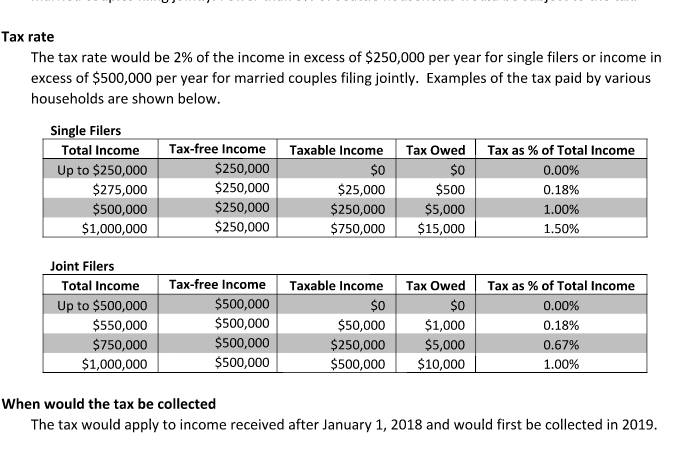

According to an official summary, the tax would apply to total annual income that exceeds $250,000 per year for single filers or $500,000 for married couples filing jointly. Anyone who earns less than a quarter million bucks a year would be wholly unaffected by the tax. The tax rate is 2 percent, so a single person earning $300,000 per year would pay $1000 into the tax annually—or 2 percent on $50,000.

If city leaders pass the law by July 10, as they have said they intend to, the tax would go into effect on the first day of 2018. City analysts estimate that the tax, which would be collected via the Department of Finance and Administrative Services, would bring in about $125 million in its first year. The funds would be earmarked for lowering property and sales taxes, replacing federal funds if they get cut, providing public services, and implementing and administering the tax itself.

Conventional wisdom holds that income taxes are illegal under the Washington State Constitution as interpreted in the 1933 state Supreme Court case Culliton v. Chase. But as we’ve reported previously, the Culliton ruling took place under unusual circumstances, and some legal scholars believe that today’s state Supreme Court would reject Culliton’s precedent. That’s part of the point of the law, at least for activists: if Seattle’s law passes and survives a court challenge, it could replace the Culliton precedent and allow income taxes to be contemplated by state and local governments. Washington has the single most regressive tax structure in the country, which is to say our taxes fall heaviest on poor people and least on rich people.

The current push for a Seattle income tax began in the wake of Donald Trump’s election. Rallying under the name Trump Proof Seattle!, progressive tax activists have been laboring for months in the mineshafts of public testimony. On April 21, they hit gold, when Mayor Ed Murray announced at a candidate forum that he would send an income tax bill to city council in the coming weeks.

Now, he has. Take a look for yourself at the bill and summary.

cjaywork@seattleweekly.com

This article has been updated, and edited to correct the dollar-cost of the tax to someone earning $300,000 annually.