If one subject in Olympia divides Republicans and Democrats even more than the aisle separating seating in the House and Senate, it’s taxes. Democrats push for more of them; Republicans despise them.

At least that’s how it usually plays out.

But when Democratic Governor Jay Inslee introduced the key aspects of his 2015–17 budget proposal late last year, one new tax brought the two sides together in relative silence. While revenue-generating items like a capital-gains tax and a tax on carbon polluters were met with scorn from Republicans, a tax that (according to the state Department of Revenue) will bring in nearly $42 million in new revenue over the next biennium failed to generate more than a peep of opposition.

The tax in question is Inslee’s proposed 50-cent-per-pack hike on cigarettes, which—if approved—would bring the state tax on cigarettes up to $3.525 per pack (yes, there’s such thing as a half-cent). And while the money this tax would presumably generate is chump change compared to something like a capital-gains tax, if Washington legislative history has shown us one thing, it’s that increasing revenue from the pockets of smokers is an idea nearly everyone can get behind. Over the past 20 years, the state cigarette tax has gone up nine times. In 1993, the tax was just 34 cents per pack; in the two decades since, it has increased by nearly 900 percent. That revenue goes straight into the state’s general fund.

Given this precipitous rise, perhaps it should come as no surprise that the sale of untaxed cigarettes in Washington is big business. According to Department of Revenue estimates, nearly one-third of all cigarettes sold in 2013 were contraband—a number that doesn’t include the untaxed cigarettes sold legally on reservations through tribal contracts and compacts, or cigarettes sold on military bases. By the DOR’s calculations, the 33 percent equates to nearly $320 million in lost revenue for the state. And 2013 was nothing compared to the previous year, when, the DOR says, more than 35 percent of all cigarette sales were contraband, and Washington lost out on just over $357 million.

Cigarette smuggling takes many forms. At its most basic, residents of border towns like Vancouver or Spokane buy cheap smokes in neighboring states. That’s to be expected when Washington has the sixth highest cigarette tax rate in the nation, Oregon has the 28th, and Idaho has the 41st, at only 57 cents per pack.

But it also gets far more complex. There is commercial cigarette smuggling, which usually involves large trucks packed with cigarettes making their way from nondescript warehouses across the country to your local smoke shop. Then there’s international smuggling, with cigarettes made to look like name brands manufactured in places like Vietnam and then shipped, undetected, into the United States for sale to unsuspecting consumers. In one such case, the owner of Lovely Nails and Beauty Salon in Kenmore, Han Bui, pleaded guilty in February 2013 to the illegal importation and sale of untaxed cigarettes over nearly two years.

According the the U.S. District Attorney of Western Washington’s office, which prosecuted the case, “When a search warrant was served on [Bui’s] home in July 2011, she possessed more than 400,000 contraband cigarettes, along with $115,500 cash, and a Lexus SUV that she admitted was purchased with the proceeds of her cigarette trafficking.” Bui was ultimately sentenced to 18 months in prison and three years of probation, and ordered to pay nearly $250,000 in tax penalties. Her Lexus was seized by the government.

What’s perhaps even more surprising than the fact that roughly one-third of cigarettes currently sold in Washington are contraband is that the lawmakers and number-crunchers in Olympia are well aware of this. When it comes to raising taxes on smokes, it’s an accepted part of the numbers game. The Department of Revenue regularly incorporates the theory of elasticity into the fiscal notes that accompany all tax-hike bills. Elasticity, in this case, is the admission that when taxes go up on smokes, a certain number of people will stop, some will smoke less, and some will find cheaper sources.

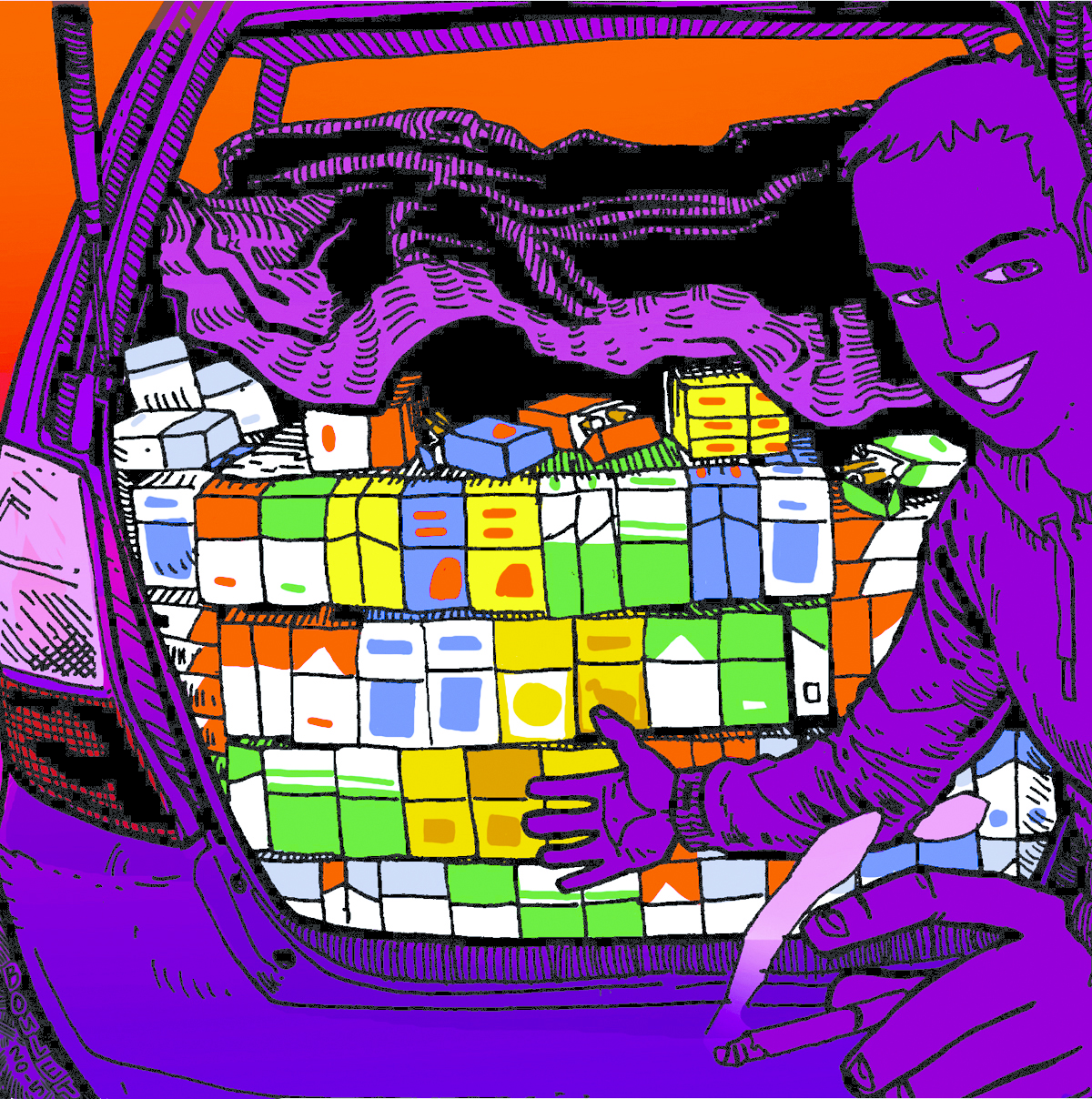

“People find all sorts of ways of getting [cigarettes],” says DOR economist Steve Smith. “There are people who sell them out of the trunk of their car.”

For example, when in 2010 the cigarette tax jumped from $2.025 to $3.025 a pack, the number of contraband cigarettes consumed in Washington went from 71.5 million packs to 94.1 million, which represented an increase from 23.9 percent to 32.6 percent of the overall market. According to Smith, this came as no surprise.

The obvious question, then, is what will happen to the rate of cigarette smuggling in Washington should Inslee’s 50-cents-per-pack increase become a reality. While Smith says the exact numbers haven’t been figured yet, he does say that the DOR expects the sale of taxed packs of cigarettes to fall from 123 million a year to 116 million under Inslee’s plan.

More severe projections come from the Mackinac Center for Public Policy in Michigan, a nonprofit think tank that spends much of its energy pushing market-driven approaches to taxation. (Disclaimer: Yes, it’s often referred to as “right wing” and/or “conservative.”) Since 2008, the Center has published a yearly report on the rate of cigarette smuggling in 47 states. In 2013, the Center found that Washington had the third highest smuggling rate in the nation, with a total of 46.37 percent of all packs sold deemed contraband. (It’s important to note that Mackinac’s 47-state model for calculating cigarette smuggling doesn’t take into account Washington’s tribal contracts and compacts for cigarette sales.)

As Michael LaFaive, director of the Mackinac Center’s Morey Fiscal Policy Initiative, sees it, Washington’s high rate of cigarette smuggling will only increase with each new tax hike. Asked to crunch the numbers on Inslee’s proposal, LaFaive predicts that the smuggling rate will rise by more than six percent, and the net revenue gain will be as little as roughly $14 million.

“Our conclusion is [that] the high excise taxes on some states’ cigarettes is the primary driver of illicit trafficking. The best way to thwart the illicit trafficking is to lower excise taxes,” LaFaive tells Seattle Weekly. “Now, we’re not so naive as to believe that politicians are going to learn how to do that, because many state capitals are as addicted to tobacco revenue as some people are to nicotine. So we hope they will consider lowering excise taxes perhaps as part of a larger enforcement package.”

At this point, and whether or not Inslee’s new cigarette tax comes to fruition, no such law-enforcement package is planned. In fact, according to Mikhail Carpenter, a spokesperson for the state Liquor Control Board—one of several state and federal agencies responsible for investigating cigarette trafficking—cracking down on the crime has been a dwindling priority. “We have not had any big cases of contraband smuggling in the past couple years,” Carpenter says. “Due to budget constraints, we have to be strategic in allocating our resources.”

mdriscoll@seattleweekly.com