Individual Retirement Account is an account that was approved after the 1970s for tax benefits to people after retirement.

Over the years, retirement portfolios have seen so many variations. There are so many types of accounts for retirement as well.

There is a traditional and Roth IRA, self-directed IRA, and even SEP one. It’s well suited to have a retirement account where the money or assets are not just sourced from one place.

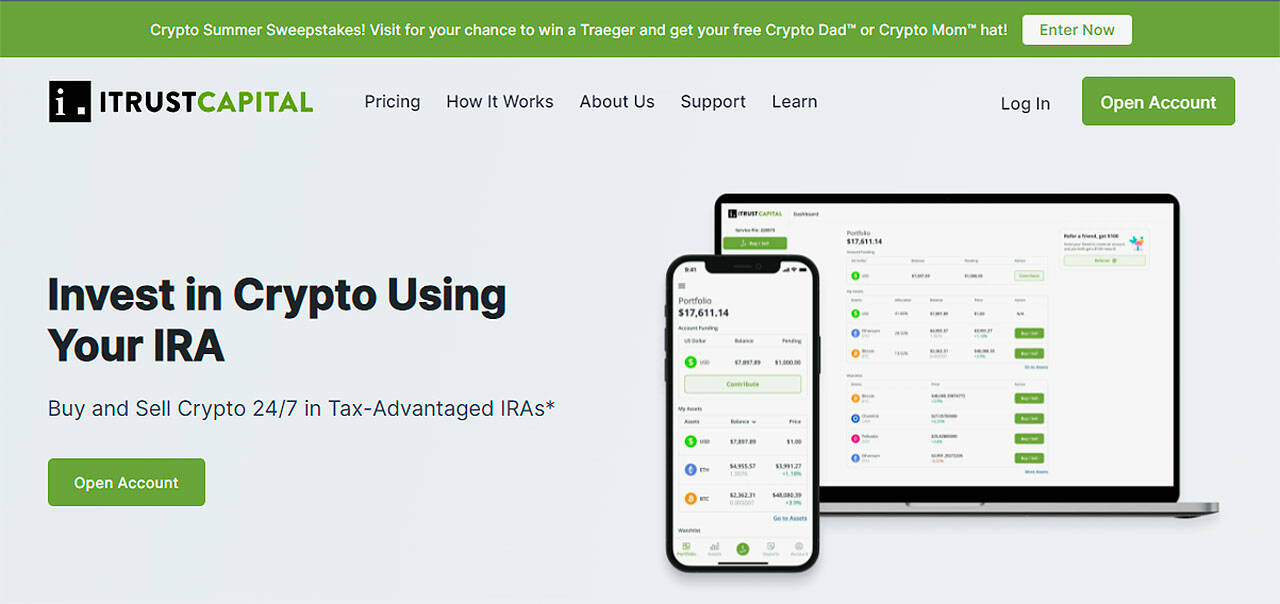

An innovation to that iTrustCapital. With an iTrustCapital account, you can easily transform your old account and start to buy and sell crypto. Apart from cryptocurrency exchanges, you can also trade in precious metals such as gold and silver.

With that, you get tax benefits. A crypto IRA provider will only cost nominal fees when you buy and sell crypto. In this article, we will talk about iTrustCapital as a crypto IRA provider and how it’s beneficial to make an iTrustCapital account.

| Brand Name | iTrustCapital |

|---|---|

| Headquarters | 18575 Jamboree Rd Suite 600, Irvin, CA 92612 |

| Founder | Tadd Southwick |

| Website | https://itrustcapital.com/ |

| Features |

|

| Benefits |

|

| Insurance and Custody | Custodial partnership with Coinbase custody insured $320 million. Insurance by FDIC (Federal Deposit Insurance Corporation). |

| Safety | It is linked with Fireblocks with an insurance backup of $42 million. |

| Types of IRA needed | It can work with either IRAs but makes a SIDRA account for you. |

| Fee Structure |

|

| About | It’s a Crypto IRA provider that helps people get knowledge and start trading in precious metal assets and cryptocurrencies to make their retirement accounts better. |

What Is IRA?

For tax-free growth and diversified savings, people invest in individual retirement accounts (IRA). The tax advantages get levied on withdrawals after retirement.

This tax-advantaged retirement account is for working people who want to save for retirement. The most common and old type of IRA is the traditional one.

It allows pre-tax or after-tax inputs and if the inputs are tax-deductible, you even get instant tax benefits. At withdrawal, the traditional IRA gets the tax rate that is currently on.

With a traditional one, your annual contributions cannot be more than your income for the entire year.

When it comes to the SEP-IRA account, there is not much difference to it when compared to a traditional one. They both have some rules for contributions.

SEP IRAs only allow business owners to make contributions. Now let’s move on and get an idea about iTrustCapital.

What is iTrustCapital – An Overview Of The Brand

With its headquarters in Irvin, with half a decade of experience and billions of transactions, iTrustCapital’s platform is that of an IRA educator and helper.

With the iTrustCapital IRA, you can trade in digital assets, buy and sell cryptocurrencies, and buy and sell precious metal assets. In comparison to other crypto IRA providers, iTrustCapital is the best in terms of fees.

With an iTrustCapital crypto IRA account, you can expect tax advantages and tax benefits. You can roll over from your existing IRA accounts. A crypto IRA will also come with no monthly fee.

It just has a nominal transaction fee. iTrustCapital is a great crypto IRA provider also because it has great security and insurance coverage.

With the increasing frauds with self-directed IRA accounts, security for other cryptocurrency IRAs is well taken care of.

Crypto IRA service by iTrustCapital is indeed the one that will make your retirement accounts better as it can also have existing IRA accounts transferred with simple forms.

Knowing and Understanding The Company

Tax benefits that come with crypto IRA are comparatively new to the market and people need more knowledge regarding it. The main motive of the company is to make people create better retirement accounts that have cash contributions, physical gold and silver, and other stocks and funds.

The iTrustCapital doesn’t pay interest as of now on any of your accounts. If you want to get benefits when you pay tax though, you can opt for a crypto IRA or cryptocurrency IRA.

The company is FDIC insured and all its physical gold and other assets are also inspired by the best companies. This ensures that the assets of the account holder are in safe hands.

They are safe from all kinds of attacks. With the rate that the company is growing and all the services that it provides, it’s safe to say that it will soon fulfill its purpose of getting more and more people to generate good IRAs.

What Are The Different Types of IRA Accounts?

The basic motive of crypto IRAs or other IRAs is to provide the account holder with tax-free gains. Crypto IRAs came into the market way later than traditional IRAs and Roth IRAs.

For tax-deferred gains, these were the most common IRAs used by employers. Before knowing about how the iTrustCapital IRA accounts work, let’s get to know the different types of IRAs.

Traditional IRA allows you with pre-tax dollars or post-tax dollars for contributions. They are the most common and most used tax-deferred accounts.

Tax-deferred accounts refer to the savings and investment accounts that only get taxed after withdrawal. All the savings and investments before that are tax-free.

A self-directed IRA account is the other best type of tax-free account. A self-directed IRA is the same as a Roth IRA in terms of contribution limits. Other IRAs are not said to be tax-free.

The only IRA that is said to be tax-free is the Roth IRA. The other IRA accounts are SEP-IRA and SIMPLE IRA. Now let’s check out how your IRA accounts work.

How Does iTrustCapital Operate?

The basic functioning of iTrustCapital is described below. When it comes to self-directed IRA, there are not many companies that would provide it without so and so fees.

They have yearly guidelines and videos that can help you in every step. This self-directed IRA provider works with no setup fees. You can trade your existing IRA, or any other IRA to start a new IRA.

The new IRA could be a self-directed IRA that can be used to trade in crypto or precious metal assets. A self-directed IRA can be set up with an account minimum of $1000 with no other fees by simply just filling up your information.

After you apply for it, you will get a confirmation email or an email regarding any details if required. You can then easily start your trading. You can find your account as well. Now let’s get into the details of how to set up your account.

How To Set Up An IRA Account With iTrustCapital?

With no hidden account fees, the iTrustCapital platform supports making retirement better. To set up your IRAs with iTrustCapital, you just need to fill up a simple form.

This form will contain certain personal details. After filling out the form you need to click on the submit application button. Once your application is submitted, you need to wait for an acceptance email.

Once you get the email you need to start funding your account. The minimum account balance should be $1000. Apart from that, the company also offers easy funding in three ways.

The first one is cash contribution, the second one is rollovers from existing employers and the third option is transfers from old IRA. This makes it very easy for the account holder to begin trading in crypto and serious metals.

With that said, now let’s check out the various cryptocurrencies and precious metal assets available on the company website for trading. They also have data of the same for over a month.

iTrustCapital Precious Metals

Retirement investing can’t be done in one place. Alternative investments are necessary. Apart from cash and stock, as a new medium iTrustCapital offers trading in precious metal assets.

These precious metals only include physical gold and silver. It doesn’t deal in other precious metal assets right now.

The transaction fee levied on dealing in these precious metals like physical gold and silver is nominal. For gold, it’s $50 per ounce and for silver, it’s $2.50 per ounce.

The precious metals are well protected by the Royal Canadian Mint. So you need not worry about any attack on your assets.

iTrustCapital Available Cryptocurrencies

Retirement accounts only benefit well with maximum tax-free transactions. Crypto IRA providers like iTrustCapital take care of that factor.

When you look for crypto exchanges with your accounts, iTrustCapital is the best. Their cryptocurrency IRA gets you to self-trade in digital currency like bitcoin cash and secure blockchain distributed ledger-owned assets.

There are only two secure blockchain distributed ledger secured assets in the market, that is, Ethereum and bitcoin. So that is about the available cryptocurrencies. You can check out in detail the other such assets available on their website.

A Look At The iTrustCapital Features & Benefits

Cryptocurrency has seen a considerable rise in a swift motion. Amongst the crypto IRA platforms, iTrustCapital alternatives, and other organizations, iTrustCapital’s platform has seen a growth graph like no other.

The secret behind that is the unique features and benefits. This cryptocurrency IRA broker can help you in making a free account. You can trade in physical gold and silver.

You can have a cryptocurrency exchange. You can easily trust them as they come with top-notch security. Now that we have a clear understanding of the system, we are going to go see the features of the iTrustCapital platform and how they can make your retirement portfolio better.

They have the best per-transaction fees and other advantages that you can put to use. So let’s check out what are those for your tax-advantaged retirement account.

Quick Application Process

Everyone is looking for time-saving options in every aspect because the world is running fast in every field. There is no time to wait for things to get loaded and buffered.

The first benefit of iTrustCapital is that an account setup is quick as ever. You no longer have to wait for a few days and stand in a few lines to get your retirement investing started.

With this account, you can buy and sell crypto and physical assets from the comfort of your home with utmost security. The application submission just requires you to fill out a form of personal details and within 1-3 days you will get your acceptance email to start funding your account, and then you can start trading.

If the application process takes time, it becomes difficult for the account holder to wait and invest. It’s a mentality that quick and easy options sell faster.

3 Funding Options

If you want to transfer funds in your crypto IRA, the iTrustCapital platform provides you with three good ways to do that.

Unlike other organizations, these three ways are pretty easy to use. You can make a cash contribution in your crypto IRA or cryptocurrency IRA. Apart from that, you can also roll over your existing employer plan.

And thirdly, you can transfer your old traditional IRAs or Roth IRA into your new self-directed IRA. These funding options are very easily accessible.

You just need to fill out some specific forms with the details that are required and you can start with your trading. The company takes care of the rest. With the forms and options, some beginner videos can help you out with any doubts.

They also have good customer care service to aid you as and when required. The trading also becomes easy as there are no monthly fees required. With that, now let’s check out the next benefit.

29+ Assets Offered By iTrustCapital

Your iTrustCapital IRA account comes with great security and a price rate like no other. Apart from bitcoin cash, you can use this account to deal in alternative assets like gold and silver.

And other than these precious metals the company has more than 29 other assets like cryptocurrencies to make your retirement portfolio better.

So let’s have a look at what other crypto assets are available other than precious metals. The company trades in Avalanche, Cosmos, Sushi, Aave, Cardano, Chainlink, Dogecoin, Ethereum, and a few others to name. And now let’s check out the next benefit of the company.

Coinbase Custody Available

Keeping the security for its customers, iTrustCapital and Coinbase Custody are now institutional custody partners. So now whatever you deal with with your crypto IRA, it is well insured.

Coinbase custody is an independent organization. They segregate and hold the digital assets for the benefit of their customer. There is no extra charge for a crypto IRA holder in iTrustCapital.

Coinbase custody makes iTrustCapital undergo regular audit checks by reputed organizations. Apart from coinbase custody, the company is also insured by $320 million that can keep the assets of the customers safe from any type of attack.

The organization has a vision of providing the customers with the best service and security and it is clear from the customer service team that they are doing good in that.

Royal Canadian Minted Metals

The company only deals in gold and silver precious metals. The gold investments owned by the company are pretty safe with the Royal Canadian Mint.

The Royal Canadian Mint is a very reputable organization. It makes Canadian coins and other assets with metals like gold and silver. These assets by the Royal Canadian Mint are used by iTrustCapital in its dealings.

This ensures that the value of the assets is real and that no fraudulent assets or products are used in your investment. Moreover, the assets used should be of worth as there are many companies out there that might take disadvantage of the growing online trades.

So that is another benefit of the company. It has left no stone unturned for the comfort and security of the consumer. The Royal Canadian Mint is not the only organization. The company has tie-ups with other organizations as well.

Offers and Ensures Safety of Assets

With the increase in criminal activities and attacks on assets, people must invest in secure places. If you don’t invest in places that are insured there might be a high risk of your assets being lost by such attacks.

To counter that, the iTrustCapital has taken security very seriously. The safety of all your assets is well guarded under the company and its insurance.

It also has a custody tie-up with Coinbase custody which is the best in its field. Crypto investments are subject to lesser risks as compared to physical assets but the risk is still there.

All the securities taken up by the company are the ones that are similar to the banking and military sectors. Personal account protections are undoubtedly in the best hands.

They also have two-factor authentication. personal account. All this makes it a very litigious organization where people can easily trust and handle their assets without any issues.

Pricing and Fee Structure of iTrustCapital

iTrustCapital’s platform has account minimums of $1000. The account minimums might be difficult for people but it’s well worth it. The per-transaction fee is levied on cryptocurrency and gold and silver.

There are no setup fees. The iTrustCapital reviews say so much good for the same. There are no monthly fees, the monthly maintenance fees are also taken up from the fees that you pay as such.

The structure is a set of transparent fees. It makes it very easier for a consumer to invest. The iTrustCapital reviews also appreciate the easy flow of customer service for any doubts.

This makes it so much easier for the consumer to begin with self-trading which doesn’t get taxed. These few structures are hardly found in any leading companies.

Most companies make transaction fees or setup fees pretty high for an account holder. Now let’s check out what your account would include.

What’s Do You Get With iTrustCapital Account?

Crypto IRA with your iTrustCapital account won’t have any hidden fees or monthly fees. You have account minimums of $1000 and the maximum depends on the IRS rules.

With your investment, you get their amazing phone customer service to help you in your time of need. Even though there are no hidden fees, there are transaction charges.

Your account will include funds in the form of cash contributions. You can also roll over your existing employer plans or existing Roth IRAs.

You can self-trade in physical assets or precious metals. You can even begin trading in crypto. With these benefits, you also get a clear record of all the assets and their rates for over a month.

The company is reviewed by a lot of media and also has a great customer rating. With that said, now let’s move to check the pros and cons of the iTrustCapital.

Understanding The Advantages and Drawbacks Of iTrustCapital

Major cryptocurrency exchanges take a lot of time and energy and even require a mediator at times. But with the iTrustCapital, you can deal in crypto-assets and physical gold and silver on your own without any time restriction.

Their phone customer service and a message us link work very well. There have been no negative reviews about that. Their customer service time is on legs to help you anytime you want. It works for better financial relationships.

There is no monthly fee or hidden fees. A nominal transaction fee is supposed to be paid when you’re dealing in gold and silver. Transactions of cryptocurrency exchange also get charged a 1% transaction fee.

Other than precious metals like gold and silver, the company also deals in alternative assets that are listed on its website. If you wish to open a crypto IRA the account minimums to $1000 only.

There is no annual fee on cryptocurrency IRAs. Although as of now they aren’t paying any interest. The only drawback is that they do not have any mobile app to work on.

They also don’t provide any investment advice. Other than that the company is a must-try.

Final Verdict – Is iTrustCapital Worth It?

With the advancements in time, it’s become very necessary to get a retirement portfolio that is a mixture of stocks, assets, funds, and precious metal assets as such.

If you opt for investment advice, you will be directed to cryptocurrency IRAs. And where to go for a crypto IRA? You should go to iTrustCapital. But is iTrustCapital legit? Billions of transactions and 4 years of growth are the answer to that question.

The benefits of cryptocurrency IRAs are well known to us and the iTrustCapital is the best for it. The process to make an iTrustCapital account is very simple and it makes the account holder self-trade in crypto exchanges and physical assets like precious metals.

Even if you’re a beginner the process won’t get on your nerves. They have videos to explain everything and make you get more tax advantages and benefits. So definitely give this one a try by clicking here! >>>

RELATED POSTS: