Seattle City Councilmember Lisa Herbold told her colleagues this morning at the regular Monday council briefing that she intends to bring forward a resolution supporting a city income tax ordinance for a full council vote.

According to a draft copy of the resolution circulated earlier today, the resolution states that “the City Council intends to begin consideration of a progressive income tax ordinance by May 31 2017, with the goal of Full Council passage by July 10, 2017.” The draft resolution also notes the mayor’s office, the Council, city attorney, and members of the Trump Proof Seattle Coalition (a group advocating for an income tax to offset potential federal funding cuts under the Trump administration spearheaded by the Transit Riders Union and the local progressive think tank the Economic Opportunity Institute) will coordinate to draft a final ordinance.

The draft resolution also leaves the door open on the specifics for the eventual city income tax ordinance; it states that the percentage of income taxes, the type of income (such as capital gains, interest, or broader adjusted gross income), and the income levels that are taxed have yet to be identified.

Additionally—and arguably most importantly—the draft resolution states that “legal viability” will be the principle guiding the creation of the eventual city income tax ordinance, due to the fact that the city intends to “test the constitutionality of a progressive income tax and the scope of local authority, so that a legal victory will result in new, robust progressive revenue tools for municipalities throughout Washington State.”

In short: Seattle wants to challenge the long-standing legal and political notion that income taxes are illegal in Washington State. (Washington has a highly regressive tax structure that relies almost exclusively on sales tax and property tax, resulting in the bottom 20 percent of income earners paying a disproportionate share of the income in taxes compared with the top one percent in the state.)

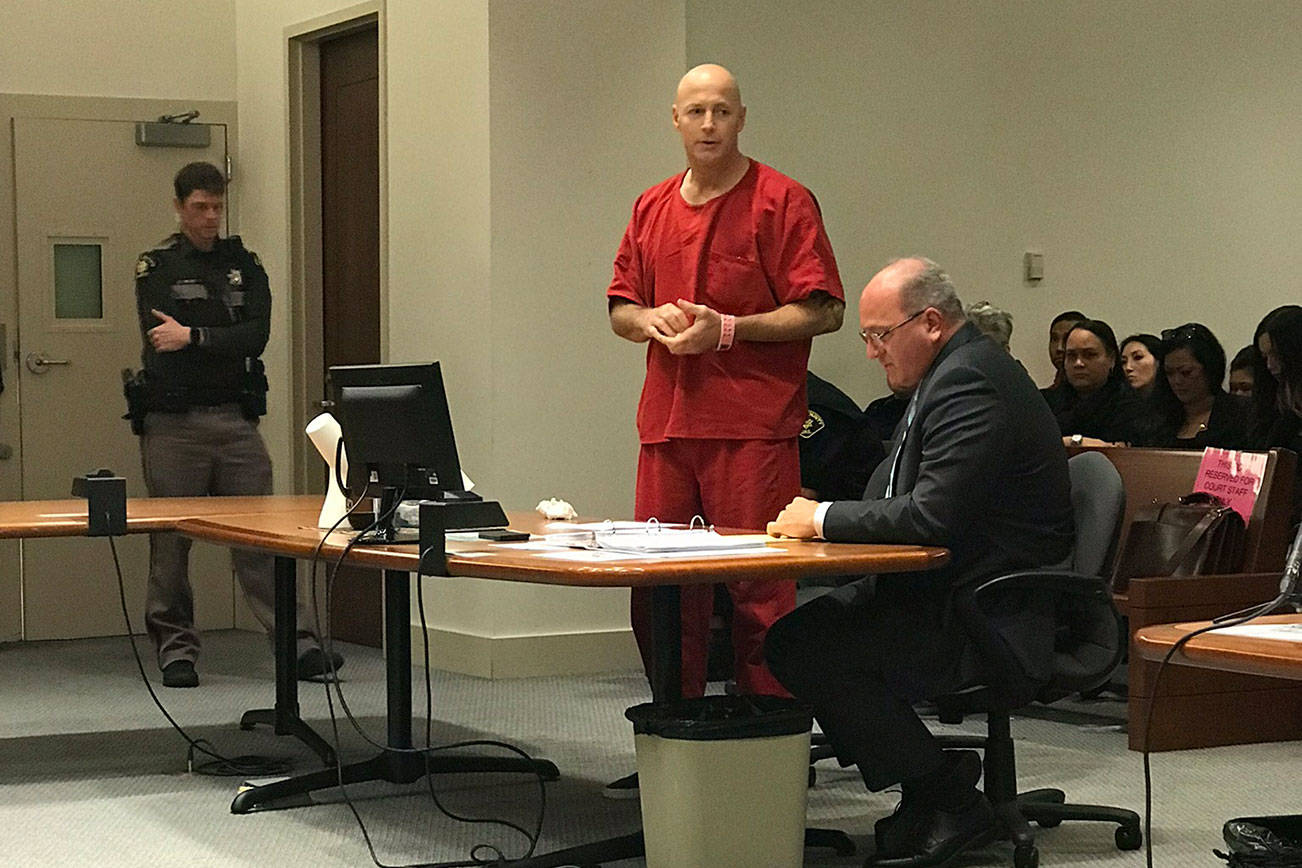

The push for a city income tax comes after a candidates forum last Thursday night in which Mayor Ed Murray—who is up for reelection this year, has already put a number of new property tax increases before Seattle voters, and is facing a slew of new challengers following accusations that he sexually abused several troubled teens in the 1980s—endorsed a city-level income tax and said that he would be sending an income tax ordinance to the City Council.

jkelety@seattleweekly.com