As city councilmembers work on passing a city budget, solutions to the growing wealth disparities and surging homelessness crisis remains at the forefront of deliberations. Yet, the Seattle City Council on Tuesday voted down a proposal that would have taxed businesses grossing more than $10 million in order to fund housing and homelessness needs.

The HOMES (Housing, Outreach Mass-Entry Shelter) plan that was defeated 5-4 would have generated about $25 million annually by employing a so-called “head tax” equivalent to about $125 per full-time employee at more than 1,000 of the city’s largest businesses. Council Members Sally Bagshaw, Rob Johnson, Debora Juarez, Bruce Harrell, and Lorena González voted against the proposal; while Mike O’Brien, Lisa Herbold, Kirsten Harris-Talley, and Kshama Sawant voted in favor of it. Drafted by Councilmembers O’Brien and Harris-Talley, the proposal would have directed about $6 million in generated revenue toward increasing the number of 24-hour shelters and services for homeless people while they wait for housing to become available. About $18 million would have gone toward investment in more affordable housing units.

“I’m disappointed because we’ve been in this state of emergency for two years,” Councilmember O’Brien said as it became clear that the tax, which would have taken effect on January 1, 2019, wouldn’t pass. Some members of the public shouted “Shame on you!” as the Council voted to remove the tax from the proposed 2018 budget. In voting against the tax, several members cited a need to have a clearer tax proposal or suggested finding alternative sources of revenue to help alleviate the homelessness crisis.

Council President Bruce Harrell suggested borrowing about $8.8 million from a rainy day fund to address homelessness while the City Council finds a more sustainable head tax or alternative revenue sources to address the crisis.

Councilmember Debora Juarez said that she supported a “head tax,” but opposed the current legislation because she wanted to have more time to consider it. “I don’t want to pass legislation that gets challenged in court and then it hangs there forever,” Juarez said, adding that she would like to revisit a head-tax proposal in 30 days.

Following remarks of disapproval from her constituents, interim councilmember Harris-Talley said that she would be joining the public after her temporary term expires on November 28 and “we’re going to hold them [councilmembers] accountable” to what they promised during the budget meeting.

To that end, councilmember Sawant said that she will propose a resolution on Monday through which councilmembers pledge to pass a head tax to fund housing and homelessness services by a date that is yet to be determined.

Councilmember González said that two days ago she had started working on her own proposal, one that would advance a policy framework that finalizes “all additional revenue sources that we could explore, including an employee hours tax to meet this particular need.”

An existing employee head tax was repealed in 2009 because of the recession, and councilmembers have tried several times since to bring it back with no success. However, the latest iteration of a head tax garnered support from several councilmembers eager to find a solution to the homelessness crisis.

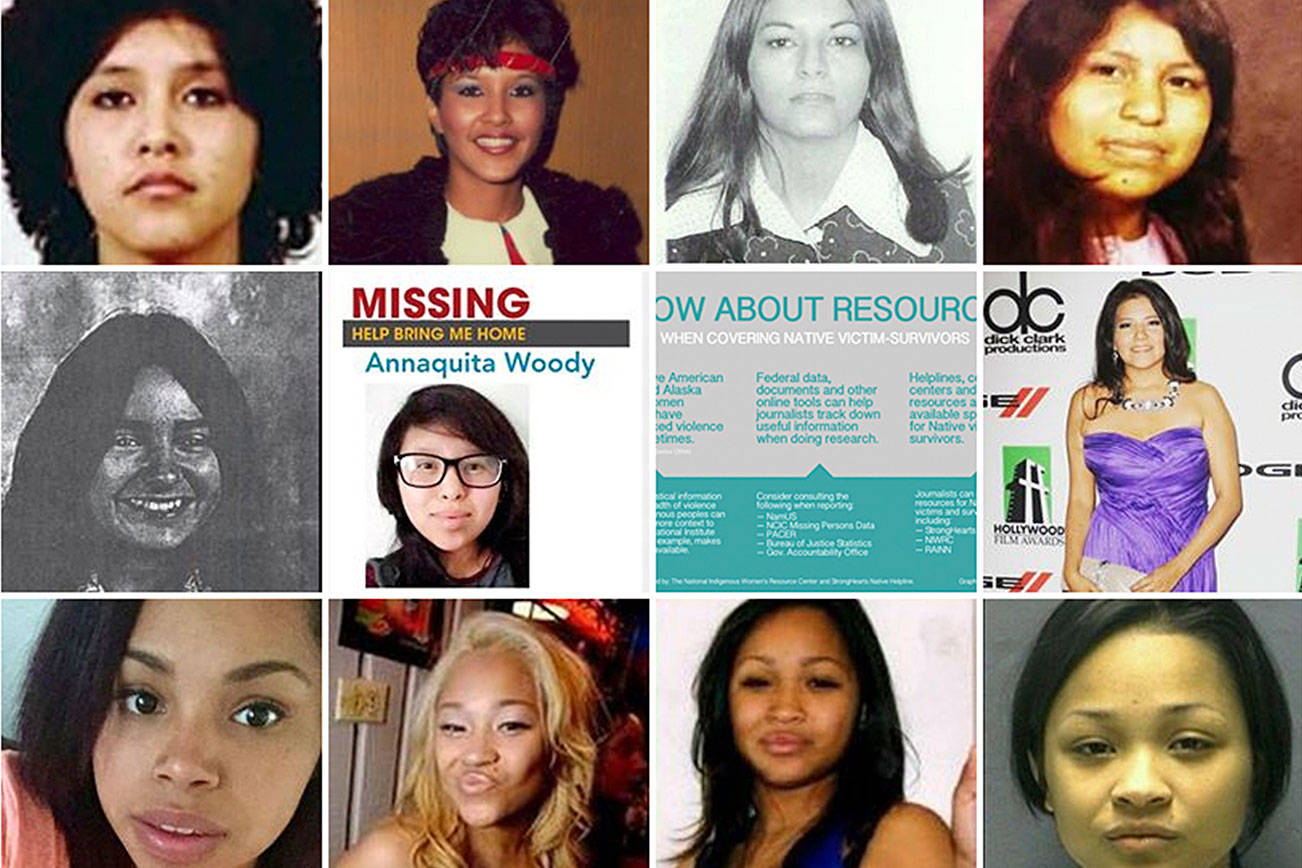

Debate on the issue had heated up Monday, prior to the Tuesday vote. During public comments at the full City Council meeting Monday, Housing for all Coalition activists wearing black approached the podium with single red roses and posters bearing a silhouette of a homeless person who they said had died last month. Coalition members said 78 people had already died this year, while 14 unsheltered people had died in October alone. Activists ended their speeches by urging councilmembers to vote for the HOMES proposal.

On the other end of the debate, about 90 businesses signed a letter addressed to the City Council Monday that opposed the HOMES proposal, stating that the tax was akin to finger pointing. Instead, they suggested that the Council consider a more inclusive approach to the homeless crisis. “We want to speak, but the threat of bullying or the fear of wasting time, does not give us confidence that you are interested in listening,”the businesses wrote.

mhellmann@seattleweekly.com