Remember that Tom Cruise sci-fi movie where the aliens kill him over and over in a time loop until he figures out how to beat them?

That time loops exists in Olympia. Washington’s Legislature has mastered the repeat-after-repeat part. But everyone is stumped on figuring out how to get out the time loop.

On Thursday, the Associated Press held its annual legislative preview with Gov. Jay Inslee plus Republican and Democratic legislative leaders in Olympia. Other than a trial balloon floated about using all of Washington’s marijuana tax money for education, the press session showed each side with the same approaches each had in 2013, 2014, 2015 and 2016.

For four years, Inslee has pushed lots of new taxes and tax-break closures to comply with a 2012 Washington Supreme Court ruling that the state’s basic education is unconstitutionally underfunded. He rarely offers the GOP-controlled Senate anything in return for passing his yearly tax proposals — with Republicans annually defeating most of his efforts.

For this year, Inslee wants $4.4 billion in new capital gains and carbon emissions taxes, changes in property and business-and-occupation taxes, and from closing tax breaks for 2017-2019, with $2.75 billion of that to deal with the Supreme Court ruling. Again, he offers nothing to Republicans to entice them to remove the bottleneck. His latest package contains the largest tax package that Inslee has ever proposed.

Meanwhile, for four years, Republicans have dragged their feet on addressing the 2012 Supreme Court decision — the so-called McCleary ruling. For years, they have not offered a fix-it plan beyond the economy will magically produce new money without needing any tax increases nor tax-break closures. Essentially, the GOP’s master strategy has been to stall and hope the problem will go away.

This year, the GOP strategy looks no different.

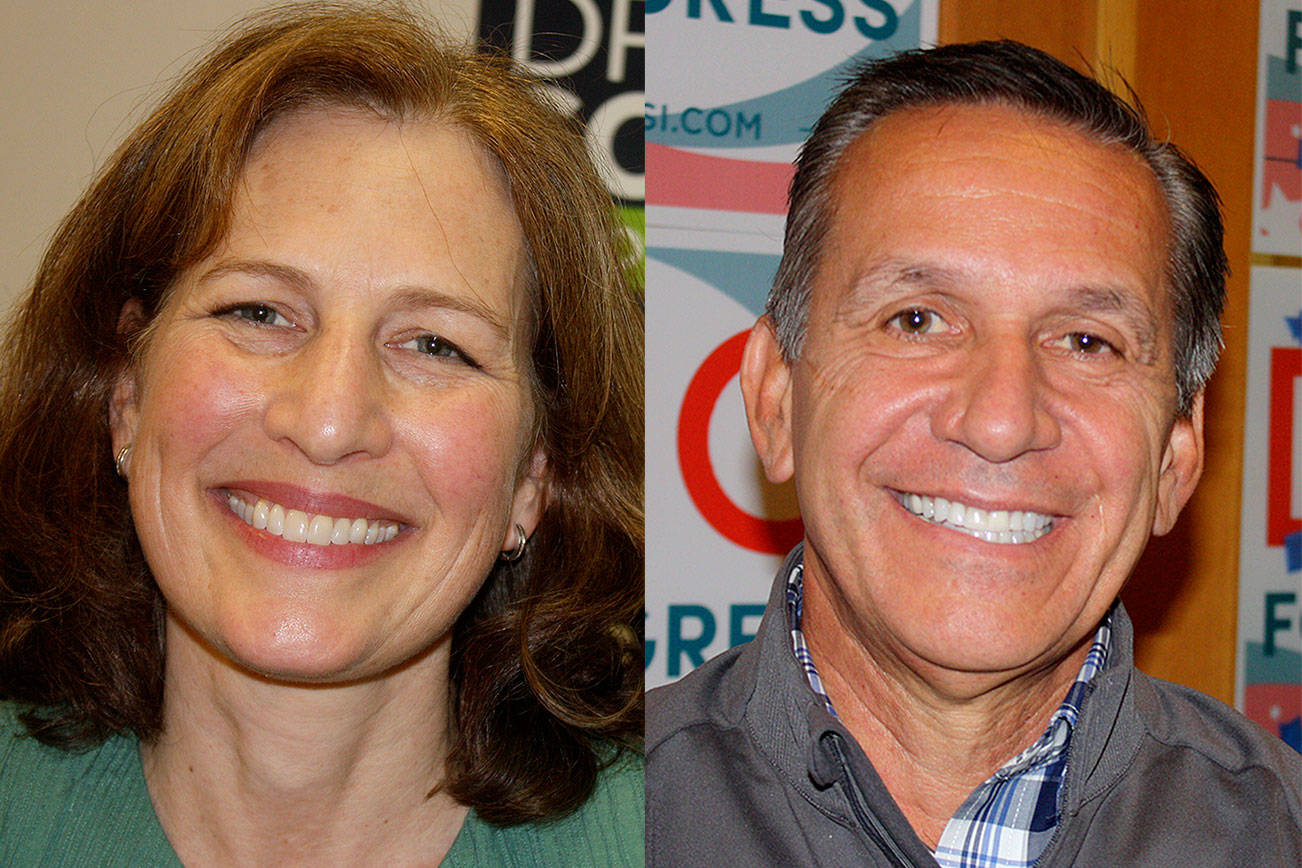

The exception was that trial balloon, floated by Sen. Ann Rivers, R-La Center, suggesting all of the state’s marijuana revenue be used for education. “I’m gonna take some heat (from the Senate GOP caucus ) for this. … $732 million in the upcoming biennium — that’s not small potatoes,” Rivers said. Rivers is the Senate GOP’s leader on marijuana issues and its lead negotiator on McCleary matters.

Her idea surprised Inslee Thursday. “Frankly, I haven’t thought about that,” he said.

Inslee and House Majority Leader Pat Sullivan, D-Covington, said using marijuana revenue for education could be considered as an option. But Sullivan added that research is needed on what happens if the current marijuana tax revenue gets rerouted.

Beyond Rivers’ pot plan, the GOP does not have any revenue plans prepared for the McCleary issue.

Four Republican legislators and four Democrats — led by Rivers and Sen. Christine Rolfes, D-Bainbridge Island—discussed a supposed joint plan for seven months in 2016. The result was a plan by the four Democrats to raise another $7.3 billion for McCleary purposes by 2021 with a capital gains and carbon emissions tax, plus a change in how property taxes are levied.

For their part, the four Republicans came up with a statement of guiding principles with no dollar figures nor revenue proposals. Both stances were announced Wednesday.

Both Rolfes and Rivers originally hoped to have something solid proposed by each side by now so the Republican and Democratic caucuses could start negotiations this month.

“I think you’ll see a plan in good time. … Every year, they’ve been saying the sky will fall unless we have the biggest tax increase in history,” said Senate Majority Leader Mark Schoesler, R-Ritzville.

Rivers voiced optimism, saying the two side are closer together on many issues that they appeared Thursday. Roles contended if the GOP’s actual plan does not materialize until February, that will likely send the legislative session into overtime. In two of the last four years, the Legislature risked a partial government shutdown because it extended McCleary budget talks to mid-summer. Rivers speculated that the GOP might have some school-funding bills ready in a couple weeks.

Democrats slammed the GOP’s lack of a plan after seven months of discussions. “It’s hard to see how close we are when the homework hasn’t been done,” Sullivan said.

House Minority Leader JR Wilcox, R-Yelm, responded: “This is not a small group decision. It’s the biggest part of the budget.”

Meanwhile, Inslee was unapologetic about the size of his tax package and its apparent lack of olive branches to the GOP. “We sized it to fit the jobs” of numerous school and mental health funding obligations, he said.

Inslee argued that his tax package has Republican-friendly features such as reducing property taxes for 75 percent of the state’s land owners, a carbon tax that would help provide more water to farmers who have been losing irrigation water due to global warming, capital gains taxes to reduce tax burdens on poor people, and reducing the B&O taxes on the smallest business owners.

Schoesler addressed only one of those tax proposals Thursday, saying Inslee’s B&O tax changes probably won’t work. “No one has found a magical formula to replace the B&O tax,” he said.