Investing in the stock market is a mug’s game. My father, a Ph.D. psychologist intent on getting a better return on investments for my college education, lost his entire savings in the stock market by betting on stock that became worthless. Twice. With Wall Street, amateur investors find themselves pitted against professionals who study the market every day of their lives. You can get lucky and win, or you can pay (often handsomely) for someone to manage your portfolio for you. But the risk is considerable that your returns, including expenses, will not match inflation.

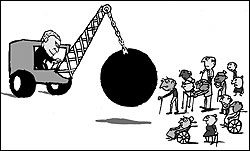

This, in essence, is why President Bush’s Social Security privatization plan is such a cruel hoax. When Dubya says that ordinary investors, under his plan, would come out better than they currently do with the Social Security trust fund—which is invested in safe, nonmarket government securities, and don’t forget to deduct the 3 percent Bush’s plan would take for the government off the top—what he means is that people with the time and/or resources to master the market are likely to do just fine. But somebody’s got to lose in this game, and more than likely it will be precisely the classes of people who most need the cushion of Social Security—the poor and middle class after their working years, the disabled, and the orphaned.

This is without even considering the overall economic impact of the switch to a partial privatization plan—now estimated, in one of those numbers too large to mean anything but sure to grow further, at about $2 trillion. If you’re counting, that’s $2,000,000,000,000 that the federal treasury currently doesn’t have, a degree of fiscal recklessness that can only be considered stunning. And for what? This scheme exists for one reason: to enable Wall Street to get its greasy hands on an enormous pool of government money that for 70 years it has been unable to touch.

How do we know this is the motivation? Essentially, by process of elimination. It’s not because (spin notwithstanding) it’s a good idea for workers. It’s not because anyone is demanding it; a CNN/USA Today/Gallup poll showed an amazing 75 percent of poor and middle-class workers opposed Bush’s plan, with a bare 49 percent approval among the wealthy. And it’s not because Social Security is in some sort of alarming crisis for which there is no other fix.

There is no crisis—weapons of mass destruction, anyone?—and to the extent the Social Security system needs tweaking, there are plenty of other less severe, more prudent solutions. The current cap on earnings above which Social Security is not taxed could be raised from, say, $90,000 a year to $140,000. Congress could be forced to return the enormous amount of money it has “borrowed” from the Social Security trust fund over the years. The plan could stop paying benefits to the wealthy. The government could invest the trust money differently. The current Social Security tax of 6.2 percent on workers (with a matching employer contribution) could be raised. Heck, if the problem is the bulge in benefits represented by baby boomers, pay for it by bringing more people into the workforce—namely, the millions of undocumented aliens now working in a shadow economy.

Extreme? Not nearly as extreme as what Bush is proposing. And we already know from other countries’ experiences that this won’t work. In the closest models, Argentina and Bolivia, the high cost of adopting the program, combined with a crushing existing foreign debt, led to the collapse of their economies and changes in government. In Chile, the model program Bush often cites, workers who opted for private accounts earned only one-third to one-half as much as fellow workers who stayed in the traditional government plan. In Britain, the partial privatization scheme led to a rash of unscrupulous brokers taking advantage of and scamming poorly informed investors. In all these cases, large numbers of people were left without enough to retire on.

In all these cases, the bottom line is that people who once had a safety net no longer do. This is what the Republicans want: to take away an annuity program that they see as an entitlement and redirect the money into the pockets of the owning class—the class that owns a lot. Democrats have to stop playing defense on this. It’s not enough to whine that this will increase the federal deficit or reserve judgment because they haven’t seen the details (i.e., the bad news, like benefit cuts), which the Republicans continue to hide. Social Security goes to the core of who we are as a society. Are we a people who believe in making sure our country’s wealth extends to ensuring a minimum standard of living for all, including the elderly and disabled? Or would we rather hang them—eventually, ourselves—out to dry in favor of another quick buck for the rich? It’s Congress’ choice. And if you don’t like the choices being considered, it’s time to start making some noise.