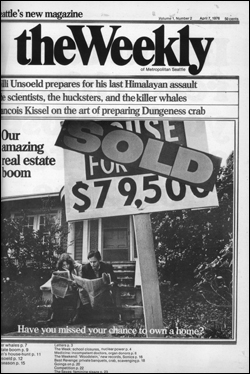

Back in 1976, when Seattle Weekly was dewy-new, our second-ever cover story was devoted to “Our amazing real estate boom.” The cover depicted a disconsolate young couple sitting on the stoop of an overgrown, more-than-modest, one-story Madrona home with a “Sold!” notice out front; the headline read: “Have you missed your chance to own a home?” We could run the same image today, if it weren’t for one thing: The unaffordable house in the photo was priced at $79,500.

Today, of course, that wouldn’t cover a condo in Kent. People spend more on kitchens. It’s the kind of dollar figure that may cause weeping, wailing, and gnashing of teeth among Seattle’s shell-shocked potential home buyers. “If only I’d gotten into the market sooner!” they moan, imagining they’d be on easy street today.

Well, having lived through the last great real-estate boom, I’m here to tell you, nothing about Seattle’s housing market is so simple. Let’s flash back to 1984. The landlord of my built-in- 1907-and-looking-it, two-tiny-bedroom West Queen Anne rental abruptly decided to move to the Southwest and offered to sell me the dump for a bargain $80,000 if I was willing to close immediately. I scrabbled frantically, found $16,000 for a down payment, and the deal was done. While we were signing papers, I asked the former owner, since she no longer had any reason for concealment, how much she’d paid for the place a decade before. She paused, pen in hand, keeping her eyes on the contract, and after a minute shook her head. “I’d be ashamed to tell you,” she said. (She was right—I found out later from a neighbor that she’d paid $18,000.)

The curious thing is how, apart from the prices, the panic market of ’04 so resembles the panic market of ’76. In his lead story that year, SW writer Patrick Douglas charted how low interest rates (9 percent!), lengthening commute times, and lagging new-home construction were driving the price of an average Seattle home to $39,500—just below the national standard of $41,000. The city was seeing a return to annual appreciation rates as high as 20 percent, levels not known since the Boeing boom of the ’60s. “This may only be the beginning,” one broker gushed. Said another, prophetically, “We thought that the gasoline crisis might shift redevelopment of areas such as Ballard and Wallingford. But it hasn’t happened.” (Hah!) Douglas concluded of housing prices, “Expensive as they may seem now, they’re not going to get any cheaper.” You read it here first.

In his companion piece, SW founder and self-described “house-hound” David Brewster wrote firsthand of the real-estate frenzy gripping Seattle. “Strangers knock at the door and ask if you want to sell. All your friends have traded up or are trying to. By the time . . . a realtor has listed a decent house on the multiple listings, it is usually already sold. Go to any open house in a home with character . . . [and] watch the Audis and Porsches and Mercedes rolling up.” It all sounds too eerily familiar.

Yet at the same time, when you wipe those zeros off the for-sale signs, the current market isn’t quite like that of ’76. Take my place—please. My $80,000 dump looks pretty much as it did 20 years ago. Based on comparable sales in the neighborhood, it might go for around $450,000. One broker even told me that, given the view of Elliott Bay through the 100-year-old American elms across the street, he wouldn’t settle for a penny under half a million. But if you construct a graph based on the (admittedly vestigial) data points provided by my experience, first-time buyers today are actually better off than I was.

Do the math: In the 10 years between my landlady’s pre-boom purchase of the house and mine, post-boom, its value more than quadrupled. In the 20 years since, it’s only appreciated by a factor of 5.7. Why, if its value had continued to climb from ’84 to ’04 at the rate it did from ’74 to ’84 (roughly quadrupling twice over two decades in noninflation-adjusted dollars), it’d be worth over a million today. No alt-weekly journalist—nor those among many other respectable Seattle professions—could possibly afford it. (Not that I’m selling anytime soon.) So what are you panicked, prospective home buyers complaining about? You’re getting off easy!